In this post we will learn how to calculate Gross Profit Ratio, step by step.

It creates a relationship between gross profit obtained and net revenue derived by operations. It also is recognized as the Gross Profit Margin ratio. The gross profit ratio is calculated in percentage.

Financial statements analysts use the GPR to determine the actual viability of a business’s sales. In certain cases, this ratio is often used to compare financial records of rivals as well as relevant market trends. The percentage is an excellent predictor of a company’s willingness to handle non-product-related operating expenditures. The greater the GPR, the greater the gross profit used to finance activities.

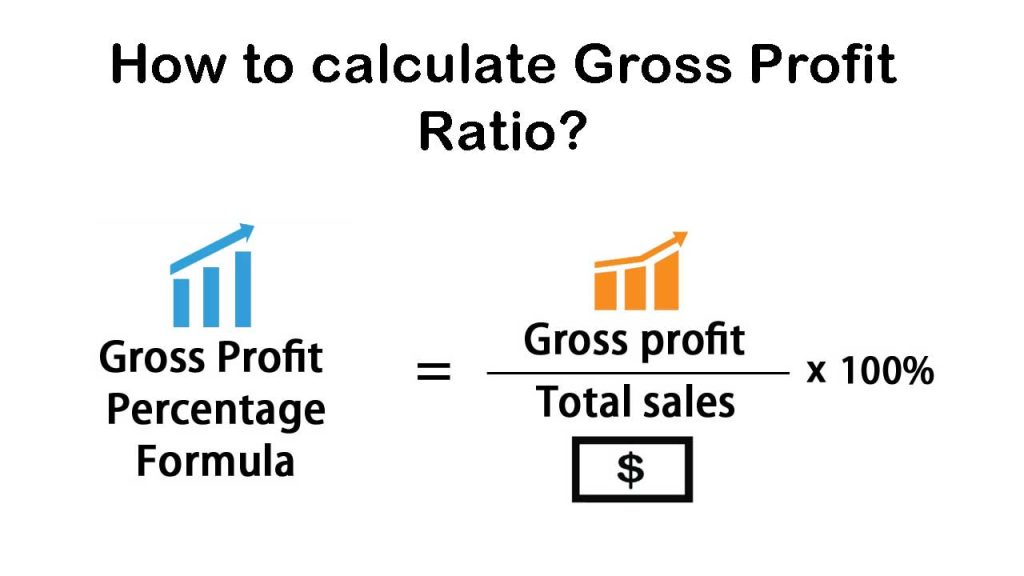

Gross Profit Ratio = Gross profit / Net Sales

Where,

Gross Profit = Net Sales – COGS

COGS = Opening Stock + Purchases + Direct Expenses – Closing Stock

Net Sales = Cash Sales + Credit Sales – Sales Returns

Must Read – What is Gross Profit Ratio?

When determining the GP ratio, these procedures must be followed.

Collect all of the necessary metrics

Determining a business’s gross profit margin over time necessitates understanding of core financial indicators like.

- Opening stock

- Purchases made

- Direct expenses

- Closing stock

- Cash sales

- Credit sales

- Sales returns

Determine net sales and gross profit.

Following the collection of the required metrics, the two components of the gross profit ratio must be determined. Since calculating the cost of goods sold by adding the opening stock, purchases, and expenses, and afterwards deducting the closing stock, you would compute the net sales amount by adding cash and credit sales and deducting sales returns. After this, gross profit must be determined by deducting the cost of goods sold from net sales.

Make use of the gross profit ratio formula.

Divide the gross profit by the net sales to get the gross profit margin. To render the whole thing easy to understand and evaluate, it is normally multiplied by 100 and represented as a percentage This helps you to calculate the benefit percentage of the business’s sales

Calculating gross profit ratio with example

ABC LTD. is a cloth manufacturing company. Its yearly sale amounts to 2,00,000. The cost of goods sold is 50,000. Calculates its GP ratio

Gross profit = 2,00,000-50,000 = 1,50,000

GP ratio = 1,50,000/2,00,000 x 100 = 75%

ABC ltd has a gross profit ratio of .75 and Gross profit margin of 75%