How to calculate net profit ratio : One of the most effective ways to assess a business’s performance is to calculate its net profit. When all of your taxes have been paid, your net profit is how much funds you have left over. The term “net income” is often used to describe it. Since higher revenue does not necessarily lead to higher profit, net profitability is a valuable metric used by many ecommerce and retail companies to monitor.

The simple truth that you should ask is how much money you will have at the end of the day, is determined by net profit. Productive businesses strive to generate a steady net profit every month. This means that the company is growing at a steady rate and that further expansion is possible. Growing companies could save for possible expenditures, pay off loans, invest in new ventures, goods, or employees, or allocate profits to investors.

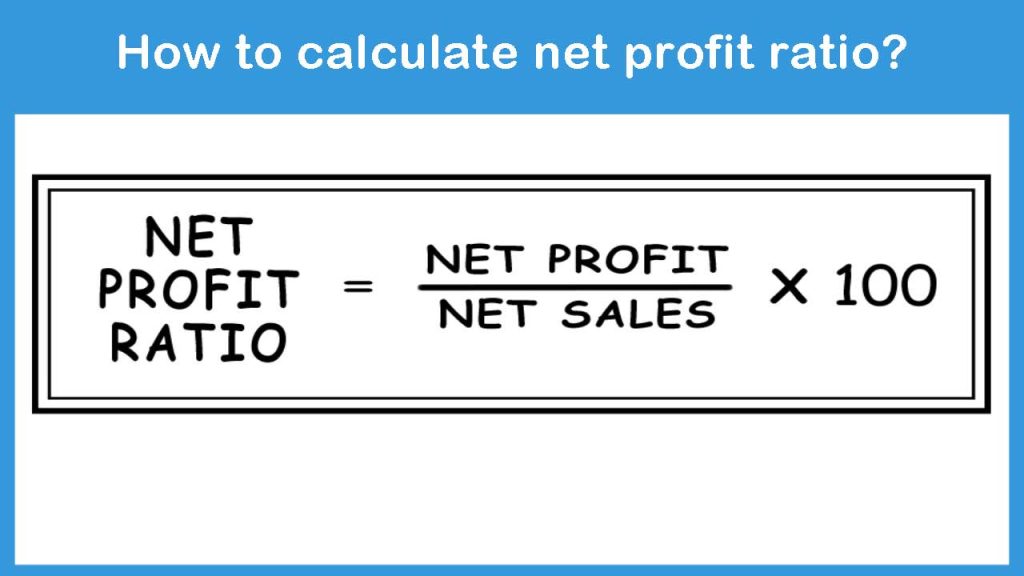

How should you calculate Net Profit Ratio?

The following is the net profit ratio formula.

Net Profit Margin Ratio = Net Profit / Net Sales

The measurement of net profit ratio entails a lot of estimates, but choosing which profit to use for the measure is a challenge. Different amounts of profit are possible.

Profit before Interest and Taxes

Many writers of financial accounting books suggest using PBIT to calculate net profit ratio because it eliminates the impact of different types of financing. This is especially helpful because the aim of estimating net profit ratio is to evaluate a company’s operational efficiency. The ratio could be compared to the industry and rivals for this profit.

Profit after Taxes

In the traditional method of estimating the ratio, this benefit is taken into account. When measured with PAT, the margin depicts the impact of all business activities, taking into account that asset finance is not really a distinct but essential business operation.

There is no clear criterion for net profit margin as a percentage. Since a small company’s net profit ratio and a large company’s net profit margin can never be similar, a single measure cannot be established. As more than one FY information is provided or if the market or competitor’s net profit ratio are accessible, the analysis becomes more relevant.