Income Tax Return

Filed By CA

Get Experienced CAs to file your ITR instead of Generalized Softwares or Executive Staff.

Get Proper Tax Planning & Maximum Refunds.

File your ITR from the convenience of your own home, with trust and ease. We make it possible for you to get the help of the experienced CAs & tax professionals in India. Our team is focused on filing accurate returns, claiming maximum deductions, and receiving maximum tax refunds.

100% Confidentiality

Maximum Refund

Expert CA Guidence

Our Pricing

Package 1

₹1,499

- Income From Salary & Other sources

- Pan Card, Aadhaar Card, Form-16, Bank Statement, Salary Slip

Package 2

₹1,999

- Income From Salary, Other sources & House Property

- Pan Card, Aadhaar Card, House Property Address And Rent receipts, House Tax Receipt, Form-16, Bank Statement

Package 3

₹2,499

- Income Generated From Capital Gain & Other Sources

- Pan Card, Aadhaar Card, House Property Address And Rent receipts, House Tax Receipt, Demat account statement, Bank Statement

Package 4

₹4,999

- Income Generated from Business, Salary, Firm and other

- Pan Card Of Trust/ Partnership/ Company, Pan Card Of Trustee/partner/director, Aadhaar, Card Of Trustee/partner/director, Trust Deed/ Partnership Deed/coi, Bank Statement

Package 5

₹5,999

- Income earned by Non Resident Indian (NRI) abroad and in INDIA.

- Pan Card/ Passport/ Banks Statements ,Form 16, Investment proofs, Rental Agreements, Capital Gains Statements

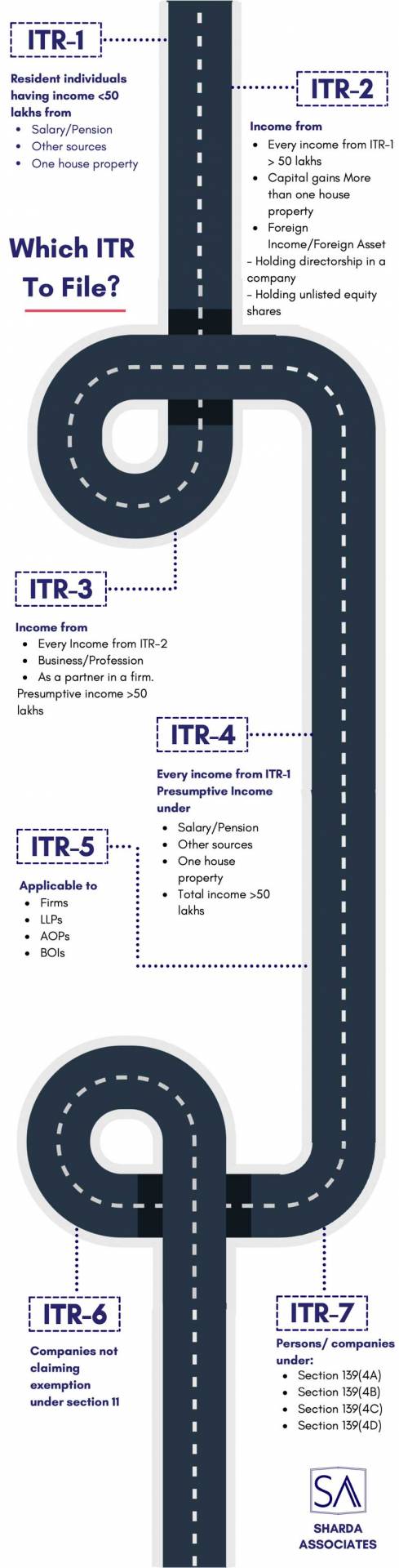

Which ITR To File?

How We Work?

Fill the contact form.

Just fill the contact form with your name & mobile no. Pay the professional fee and you will get a tax expert to guide you.

Your personal expert will contact you.

Our tax professional will gather all of the information required to complete your return (such as your income and assets) and will assist you in obtaining the maximum returns.

Relax and let us do all the hard work for you.

Our tax professional will gather all of the information required to complete your return (such as your income and assets) and will assist you in obtaining the maximum returns.

Benefits of Filing Income Tax Returns on Time

Here are few benefits of filing ITR on time.

Filing an ITR is required to avoid fines. As a responsible individual, you must file your income tax return.

ITR receipts are vital proofs of income and payment of income tax filings. The ITR receipt is a crucial record that should be kept safe.

When applying for high-value loans such as housing and vehicle loans, an ITR receipt is a vital document for hassle-free approval of bank loans.

Income tax returns for the previous years are necessary in order to submit your immigration application. They are quite strict regarding your tax status, therefore you are required to provide previous ITR filings.