What is a “Proforma Invoice,” and what does it mean? There are a variety of reasons for this document to be delivered to the buyer, most commonly before the transaction has been completed.

Hold on to your seats, because we’ll clear up any confusion you have regarding Proforma Invoice right now.

What Is A Proforma Invoice?

A Proforma Invoice is an initial bill that sellers give to their customers (potential purchasers) that highlights crucial details about the acquired items or services. Approximate pricing for products and services, invoice number, terms and conditions, the weight of the shipment (if applicable), commissions (if any), taxes or shipping expenses are all included in this invoice’s details.

Any structure or criteria for displaying the product to customers are not required by sellers. In export-import commerce, a Proforma Invoice is being used to calculate the customs duty that must be paid on the items being exported or imported. This should only contain the details necessary for the customs agency to determine the appropriate duties to levy after an inspection of the shipment’s contents.

Prior to sending them a business invoice, the seller would always send their clients a purchase order in the mail. There is no need for the buyer or seller to keep track of the bill because it is delivered prior to the transaction.

The seller offers a Proforma Invoice before such a deal is made, as we indicated previously. Due to customs requirements, it is mostly utilised for expedited shipping. Proforma invoices could also come in handy in the aforementioned scenarios:

- The consumer may well be entitled to a credit claim if you ship them faulty items, which need a credit claim against the original invoice.

- If a consumer wishes to modify their purchase following delivery, you must increase the original invoice.

Proforma Invoices can be used in each of these instances, so long as the appropriate changes are made to them. As a result, not only do you save time and effort, but you also ensure that your customers are happy.

There are many different uses for this invoice, but it serves as a good-faith gesture among the buyer and seller. There would be no unpleasant surprises or overcharges in the final transaction because the buyer has a good idea of the key product information.

In many companies, this invoice is used to approve purchases made on behalf of the company itself.

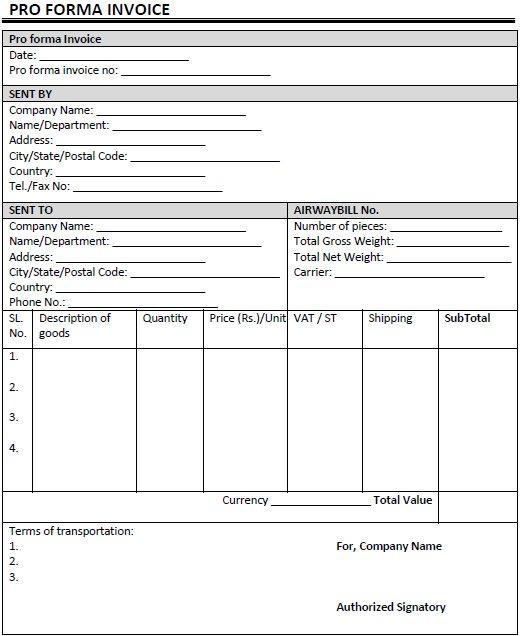

Proforma Invoice Format

It is expected that a Proforma invoice is brief and informative. In other words, just provide information that’s important to the buyer, like:

- The name of the firm and its logo.

- The bill number.

- The bill’s date of issuance.

- Both the seller’s as well as the buyer’s addresses are required.

- Unit pricing and total costs for each item on the list are included in the product details.

- Whether or whether the invoice is legitimate.

- Sale, payment and delivery conditions suggested.

- The “Customs Authorities'” certificates are necessary if any.

- Seller or other authorised firm personnel’s signature.

The purpose of this Invoice is to create good faith between the buyer and seller, as we said previously, rather than being compelled by law. Of course, the Proforma Invoice is not bound by any industry standard and might appear like a sales bill. It is regarded as one of the best business practices.

Nevertheless, a Proforma Invoice should be identified as “Proforma Invoice” to signify this is not the final sale invoice. This is critical to note. To prevent any misunderstanding on the side of the consumer, you might include the words “This is not a tax bill.”