How to calculate operating profit ratio – The operating profit ratio provides a connection among operating profit and net revenue obtained by operations (net sales). Operating profit ratio is a form of profitability ratio that is calculated as a percentage.

Net sales comprise of Cash & Credit Sales, while operating profit is the net operating profit. The Operating Profit Ratio can be used to calculate Operating Profit as a percentage of revenues made by operations.

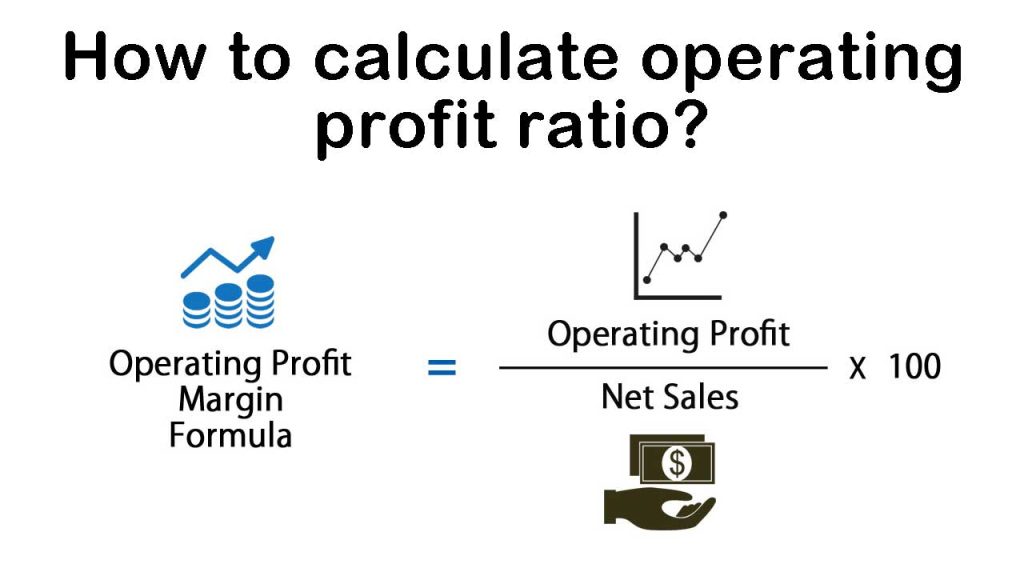

Operating Profit Ratio Formula

Operating Profit ratio formula = Operating Profit ratio formula/Net sales x 100

Operating Profit = Net profit before taxes + Non-operating expenses – Non-operating incomes

or

Operating Profit = Gross profit + Other Operating Income – Other operating expenses

Net Sales = (Cash sales + Credit sales) – Sales returns

Must Read – What is operating profit ratio?

Calculating operating profit ratio with example

Tata pvt ltd had sold salt worth 5,00,000 out of which 1,00,000 was sales return. Operating profit generated was 2,00,000. Calculate operating profit.

Operating Profit ratio formula = Operating Profit ratio formula/Net sales x 100

Net sales = Sales – Sales return

= 5,00,000-1,00,000 = 4,00,000

OP ratio = 2,00,000/4,00,000 x 100

= 50%

The operating profit ratio is 50%.

This ratio aids in the evaluation of a business’s operating efficiency; a trend analysis is often performed over two separate accounting cycles to determine the increase or degradation in operational capabilities.

A high ratio may mean better resource control, i.e. greater operational performance, which leads to better operating profits in the business.

A low ratio can suggest organizational shortcomings and poor resource management; it is an indication that the profit derived from operations is insufficient in comparison to the overall revenue produced from sales.