In this post we will learn How to calculate Return on Capital Employed, step by step.

ROCE, or Return on Capital Employed, is a profitability ratio that calculates how effectively a business uses its capital to produce wealth. The ROCE ratio is widely regarded as being one of the perfect profitability ratios and is often utilized by investors to decide if a business is viable for investment.

It is a profitability ratio that shows us how a business uses its resources and portrays the firm’s capacity to use its capital effectively. It is very beneficial from the standpoint of customers since this ratio allows them to determine if this business is decent enough just to invest in.

For instance, if two firms had identical profits but vary in their return on capital employed, the firm with higher ratio will be a good option for investors. In addition, the business with the low ROCE could be examined for other ratios. Since no one ratio can capture the whole image of a business, it is recommended that prior investing in any firm, a investor should examine several ratios to reach a firm conclusion.

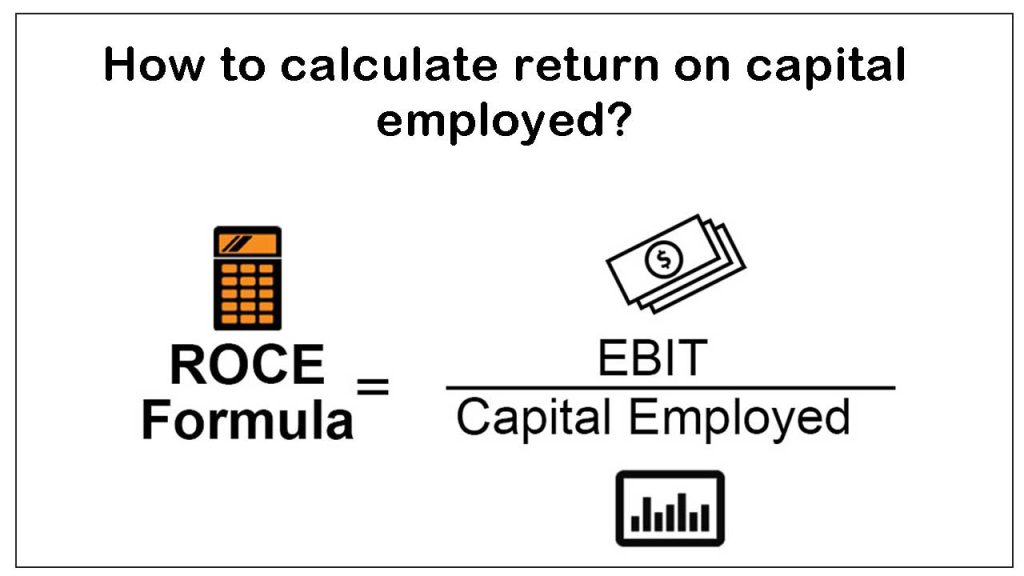

Formula For Return on Capital Employed

ROCE = EBIT/ Total assets – Current Liabilities

Earnings before taxes and interest (EBIT).

That is the business’s earnings by deducting all costs excluding interest and taxes.

Capital employed

It is the overall amount of money spent in a company. Capital employed is usually measured as total assets minus current liabilities or fixed assets plus working capital.

Let’s take an example to get a better understanding.

Calculate ROCE of ABC ltd, For financial year 2021 ABC ltc has EBIT of 20,00,000. On the balance sheet the total assets amount to 10,00,000 and current liabilities is 5,00,000.

ROCE = 20,00,000/10,00,000-5,00,000

= 20,00,000/5,00,000

= 40

ROCE of ABC ltc is 40%.

The return on capital employed is used to measure how much operating income is earned with every rupee spent in capital invested. A higher ROCE is often preferable because it means that more gains are earned per rupee of invested capital. That being said, like any other financial ratio, simply measuring a business’s ROCE is insufficient. Multiple profitability ratios, like return on assets, return on invested capital, and return on equity, can be utilized alongside ROCE to decide if a business is a wise investment or not.