Income Tax On Agricultural Income – In India, agriculture is indeed the primary occupation. For the people living in rural area in India, it is the only source of revenue. For its essential nutrition needs, the nation as a whole heavily relies on farming. The government has a variety of initiatives, programs and other steps, one of which is an income tax exemption, to encourage growth in this field.

It does seem as if the income tax exemption is everything we need to consider whenever it refers to agricultural income taxes, there is much more to it. Let us take a closer look at the law’s conditions in this respect.

What is Agricultural Income

The Income Tax law has its own concept of agricultural income , which comprises the three main practices that follow:

Rent or income earned from agricultural land located in India:

Rent is the reward for the correct utilization of land. There are plenty of potential sources of revenue which can be extracted from property. Fees obtained for renewal of grant of leased land will be an example. Income from land will not include interest earned through land sales.

When revenue from agricultural land is generated in the following manner:

A. Agriculture

The supreme court brought the definition of agriculture, which was not regulated by the Act, where agriculture consists of two forms of operations.

Basic and subsequent operations.

The basic operations:

It will include farming of the land and the tilling of the land, the sowing of seeds, planting and all other activities that directly involve human ability and energy on the soil itself.

The subsequent operations:

That will involve tasks such as weeding, digging soil across the crops grown etc. which are undertaken out for development and maintenance of the produce and even those practises that will make the plant ready for market use such as watering, pruning, chopping, harvesting, etc. Revenue made from saplings or seedlings developed in a nursery, whether or not basic operations are carried out on land, will also be regarded to be agricultural income.

B. Via the application of a method by the farmer or the recipient of rent in kind that contributes in the agricultural product becoming ready to be brought to the market:

These procedures require manual or mechanical operations and are usually used to make agricultural goods marketable and preserve the original character of such products.

c. By selling some agricultural commodities:

In the absence of ordinary methods used to make the commodity marketable, the revenue from purchases will usually be partly agricultural (exempt) income and partly non-agricultural (taxable) income.

In order to establish this bifurcation for agricultural and non-agricultural goods for items such as tea , coffee, rubber, etc., the income tax has issued laws.

Income extracted from farm construction needed for farming operations:

The criteria for registration as agricultural income of income derived from farm building are as follows:

a. The building must be on or in the near area of the agricultural land and is one that, because of its relation with the land, the recipient of rent or profits or the farmer needs the building to remain as a house or as a storehouse, or utilizes it for such circumstances

b. It is necessary to satisfy one of the two conditions:

The property is measured by either land income or a municipal rate calculated and obtained by government officials; OR

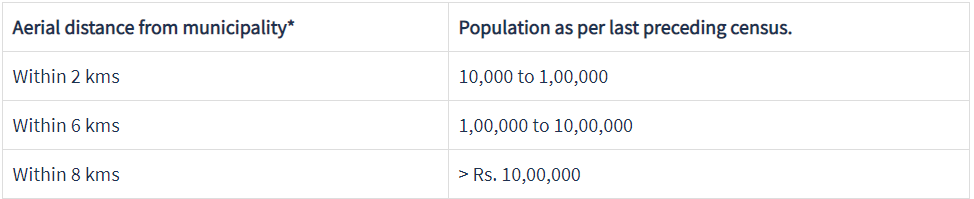

The land must not be found within the accompanying areas if the first criterion is not met:

Taxation of agricultural income

Agricultural income is excluded from income tax, as explained earlier in this post. The Income-tax Act has established a mechanism for paying certain income implicitly. The limited convergence of agricultural income with non-agricultural income can be referred to as this process or definition. The goal is to pay non-agricultural profits at higher tax rates.

When the below conditions are satisfied, this procedure is applicable:

- Individuals, HUFs, AOPs, BOIs and artificial legal bodies are obliged to use this form to measure their taxable revenue. This approach is thus exempt from the use of the corporation, company / LLP, cooperative society and local government.

- During the year, net agricultural production is higher than Rs . 5,000; and

- Non-agricultural profits are:

- For persons under 60 years of age and all other relevant individuals, greater than Rs. 2,50,000

- For people between the ages of 60-80 years, more than Rs. 3,00,000

- For people above 80 years of age, more than Rs. 5,00,000

Simply stated, non-agricultural profits should be higher than the overall non-taxable sum (as calculated by the slab rate).