MSME Finance

MSME loans are financial products specifically designed for small and medium-sized enterprises (SMEs) in India. These loans can be used for a variety of purposes, such as expanding a business, purchasing equipment or inventory, or financing working capital. MSME loans are offered by banks and financial institutions in India, and may be eligible for government schemes and incentives.

Introduction Of MSME Finance

MSME Loan for New and Existing Businesses or Enterprises is a type of credit facility in form of a Term Loan (short-term/intermediate-term/long-term), Working capital loan, Overdraft, Cash credit, Letter of credit, Bill discounting, and other funding products. Micro, Small, and Medium Enterprise (MSME) loans are available from a variety of financial institutions to new businesses, independent contractors,

MSMEs, business owners, sole proprietorships, private and public limited companies, partnership firms, limited liability partnerships, and other types of companies operating in the services, manufacturing, and trading sectors. MSME loans are typically used for expanding a business, launching a new venture, obtaining working capital, improving cash flow, purchasing items or stock, buying or upgrading equipment or machinery, paying off rent or salaries, employing and training new employees, etc.

Why Choose Us?

Guaranteed Services

Only pay for what you get we at Sharda associates ensure that are customer Get Finances and achieve business objectives.

100% Transparency

We do not make any False commitments and fake promises. we deal with 100% Transparency. and Complete honesty.

Fast & Timely Services

You will get timely finance and subsidies in least possible time. all are service are focused all quick and timely completion.

Competitive Price

Comparing the content quality & knowledge we put on our paper, our service fee are 60% lesser than other competitors.

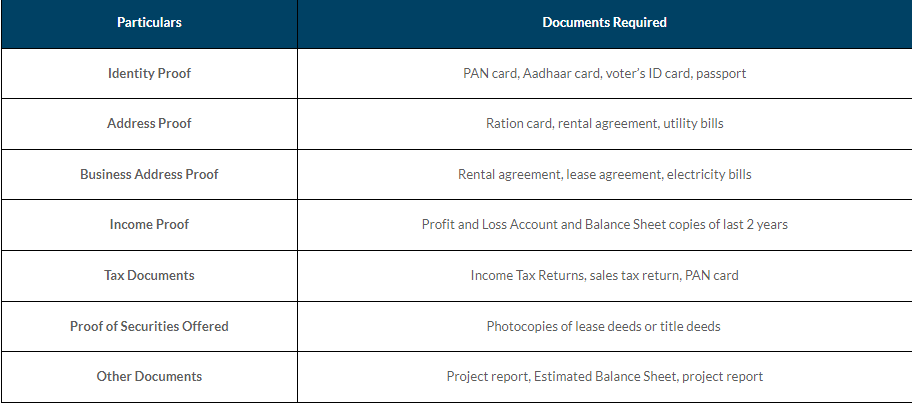

Required Documents For MSME Loan