Project Report For Cosmetic Manufacturing

Introduction

Project report for Cosmetic Manufacturing is as follows.

Cosmetics are products that are applied to the body, usually the face, to enhance or alter a person’s appearance. They are used for a variety of purposes, including enhancing one’s natural features, covering up blemishes or imperfections, or creating a certain look or style.

Common cosmetics include makeup such as foundation, lipstick, eyeshadow, and mascara, as well as skincare products like moisturizers, cleansers, and toners. Cosmetics can be made from a variety of ingredients, including natural and synthetic materials, and can be applied in a variety of ways, such as with brushes, sponges, or fingers.

The cosmetics industry is any business that manufactures and distributes cosmetics. These consist of items for the skin and hair, such as moisturizers and cleansers, as well as amenities like soap and bubble baths, as well as color cosmetics like foundation and mascara.

Project Report Sample On

Cosmetic Manufacturing

Get Completely Custom Bankable Project Report

Process of Cosmetic Manufacturing

Formulation :- The first step in cosmetics manufacturing is the formulation of the product. This involves creating a formula that includes the desired ingredients, such as emollients, preservatives, fragrances, and colorants. The formulation process also takes into account the intended use of the product and any regulatory requirements that must be met.

Mixing :- The ingredients are mixed together. This can be done using a variety of techniques, such as high-speed mixing or blending. It is important to ensure that the ingredients are mixed thoroughly to ensure a consistent final product.

Heating and cooling :- Many cosmetics require heating and cooling during the manufacturing process. This may be done to melt certain ingredients or to ensure that the product sets properly. Careful control of temperature and timing is important to ensure a high-quality product.

Filling and packaging :- After the product is mixed and any required heating and cooling has been completed, it is filled into containers. This can be done using automated filling equipment or by hand. Once the product is filled, it is packaged and labeled according to regulatory requirements.

Quality control :- Throughout the manufacturing process, quality control is essential to ensure that the final product meets the required standards. This may involve testing for factors such as consistency, stability, and microbiological safety.

Distribution :- Once the final product has passed quality control, it is ready for distribution to retailers or directly to consumers. Careful handling and transportation are important to ensure that the product remains in good condition and meets regulatory requirements.

Uses Of Cosmetic Manufacturing

Skin Care :- Cosmetics manufacturing produces a range of skin care products such as moisturizers, anti-aging creams, and sunscreens.

Hair Care :- The industry produces shampoos, conditioners, hair serums, hair gels, hair dyes, and other hair care products.

Makeup :- The cosmetic industry is famous for its makeup products such as lipsticks, eyeshadows, blushes, foundations, and mascaras.

Fragrances :- Perfumes, colognes, and body sprays are some of the most popular products in the cosmetics manufacturing industry.

Oral Care :- Toothpaste, mouthwash, and teeth whitening products are all produced by the cosmetics manufacturing industry.

Hygiene :- Cosmetics manufacturing also produces personal hygiene products such as deodorants, soaps, and body washes.

Men’s grooming :- The industry has expanded to produce men’s grooming products such as beard oils, shaving creams, aftershaves, and moisturizers.

Market Potential Of Cosmetic Manufacturing

The cosmetic market in India has been expanding at a CAGR of more than 9% over the past several years, according to India Cosmetic Market Overview, 2022-28.

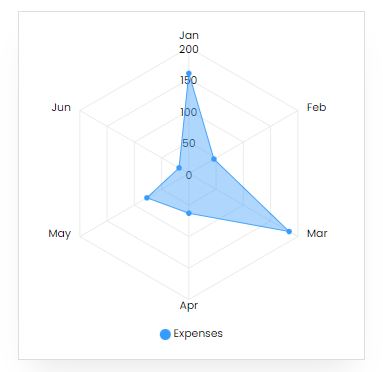

Expenses

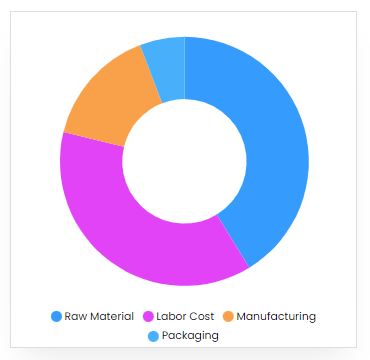

Product Cost Breakup

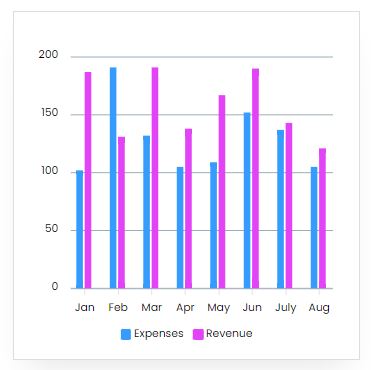

Reveneue Vs Expenses

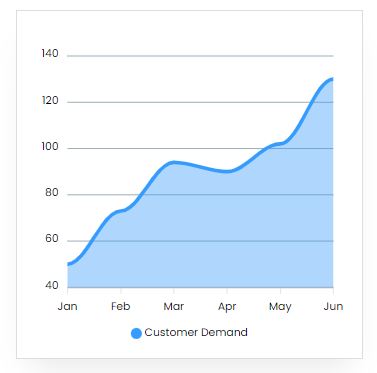

Market Trend

A significant development Potential for manufacturers is being created by the rising demand for herbal cosmetics among Indian customers. India is one of the countries that consumes the most cosmetic goods worldwide due to rising awareness of body aesthetics, particularly among women.

According on type, distribution method, and competitiveness, the Indian cosmetics market is divided into subcategories. Body care, hair care, colour cosmetics, men’s grooming, perfumes, and others are the categories under which the market is divided. Body care goods, which comprise items like hand cream and body lotion among others, commanded the largest market share in FY2020 (45.01%), and it is anticipated that this pattern will hold in the years to come.

Among the top companies competing in the Indian cosmetics market are Lotus Herbals Pvt. Ltd., L’Oréal India Pvt. Ltd., Oriflame India Private Limited, Emami Ltd., Marico Ltd., Nivea India Pvt. Ltd., Dabur India Limited, Godrej Consumer Products Ltd., Procter & Gamble Home Products Private Limited, and Hindustan Unilever Limited. Leading businesses are attempting to develop new items that meet consumer demand. Additionally, they are pursuing other growth tactics including mergers and acquisitions to grow their market share.