Sample Balance Sheet For Small Business In Excel –

The balance sheet, one of the three basic financial statements, is essential for accounting and financial modeling. The balance sheet lists all of the company’s assets along with its funding sources, which might be either debt or stock. A statement of net worth or financial status is another name for it. The basic formula Assets = Liabilities + Equity is used to build the balance sheet.

The balance sheet is hence bipolar in nature (or sections). The left side of a balance sheet lists all of a company’s assets, while the right side lists the company’s liabilities and shareholders’ equity.

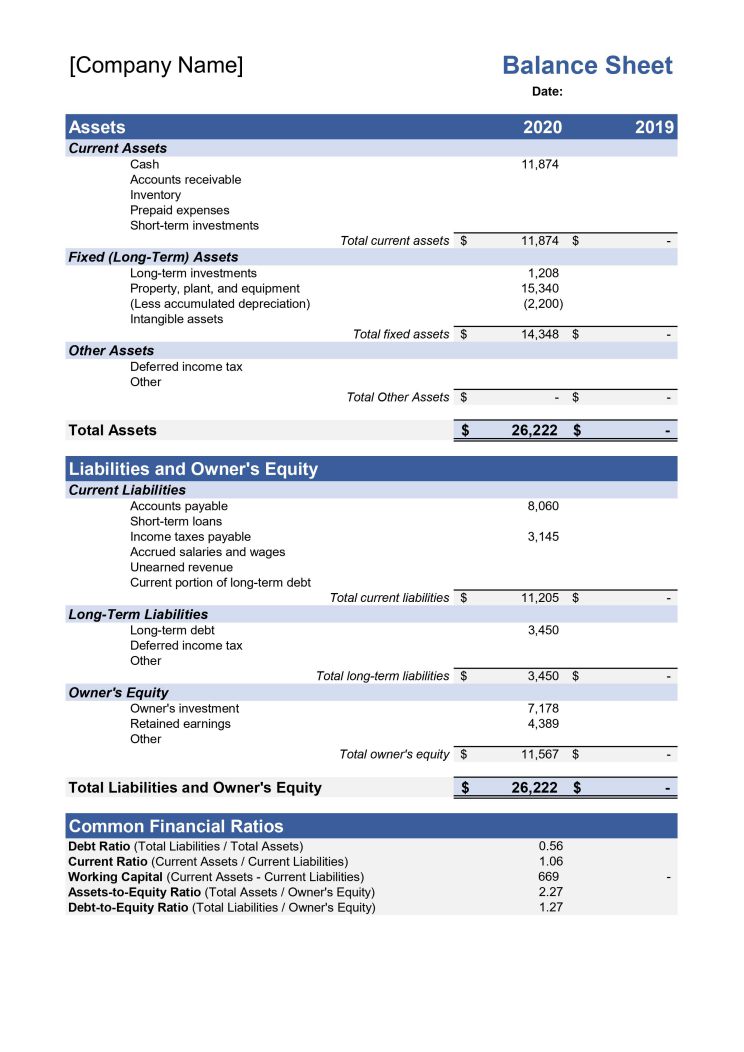

Sample Balance Sheet Image

(Download Balance Sheet Format In Excel)

The balance sheet might vary slightly between organisations and industries, just like other financial records do. On the other hand, standard balance sheets often have a lot of “buckets” and line items. We briefly discuss each of the available elements, which include equity, short-term, long-term, and current assets as well as liabilities.

Current Assets –

Cash and Equivalents

One of the most liquid assets is cash, which may be seen in the first row of the balance sheet. In actuality, this line item comprises both assets with three-month or shorter short-term maturities as well as assets that the corporation can instantly dispose of, like marketable securities. Normally, companies would list such analogs in the balance sheet’s footnotes.

Accounts Receivable

All sales revenue that is still owed on credit, less any allowances for shaky accounts, balances in this account. This account loses value as receivables are collected, whereas cash increases in value proportionately.

Inventory

Inventory includes all items, including raw materials, those that are being produced, and finished goods. The company keeps track of product sales in this account, which is frequently listed under the cost of goods sold on the income statement.

Non-Current Assets

Plant, Property, and Equipment (PP&E)

A company’s tangible fixed assets are referred to as property, plant, and equipment. After depreciation has been accumulated, the line item is indicated. Some companies may divide their PP&E into asset categories, such as land, buildings, and other types of equipment. All PP&E, with the exception of land, is depreciable.

Intangible Assets

This line item accounts for all the company’s fixed intangible assets, whether or not they can be identified. Examples of distinguishable intangible assets are patents, licenses, and secret formulas.

Current Liabilities

Accounts Payable

The debt owing by a company to suppliers for goods or services purchased on credit is referred to as accounts payables or AP. As the company settles its accounts payable, its value decreases, which causes the cash account to also decrease.

Current Debt/Notes Payable.

Include non-current obligations that are due in a year or during the operational cycle of the business (whichever is the longest). Additionally, there is a long-term version of payment notes, which consists of notes with a term of at least two years.

Current Portion of Long-Term Debt

It’s possible to merge this account with Current Debt or not. The current portion of long-term debt, despite their apparent similarity, refers to the proportion of debt that is due this year on a security with a maturity substantially longer than 12 months. For instance, if a company obtains a five-year loan from a bank, the portion of the loan due the next year would be kept in this account.

Non-Current Liabilities

Bonds Payable

The amortized value of any bonds that the company has sold is recorded in this account.

Long-Term Debt

To keep track of the total amount of long-term debt, utilise this account. The business’s debt schedule, which lists all outstanding debt, interest payments, and principal repayment for each quarter, serves as the basis for this account.

Shareholders’ Equity

Share Capital

This shows the value of the capital shareholders have invested in the company. Typically, when a firm is founded, its stockholders make a monetary contribution. For instance, an investor invests $1 million to launch a company. The balance sheet is restored by a $1 million increase in Share Capital (an equity account) and a $1 million increase in Cash (an asset).

Retained Earnings

This represents the whole amount of net income that the company has kept. A company is always free to pay dividends from its net income. Retained profits are increased or decreased by any extra or leftover money.

Importance of the Balance Sheet For Small Business

The balance sheet is an important financial statement for a number of reasons. It can be seen separately or in conjunction with other financial statements, including the income statement and cash flow statement, to give a complete picture of how well a company is doing.

Four critical financial performance indicators contain the following:

Liquidity

A company’s liquidity is assessed by comparing its current assets to its current liabilities. The business must have more current assets than current liabilities in order to satisfy its short-term obligations. Two liquidity finance ratios are the current ratio and the quick ratio.

Leverage

Analyzing a company’s funding strategy indicates how much leverage it has, which in turn reveals how much financial risk it is taking on. Debt to equity and debt to total capital ratios are two ways that leverage is frequently assessed on a balance sheet.

Efficiency

It is possible to assess how efficiently a company uses its assets by comparing the income statement to the balance sheet. For instance, the Asset Turnover Ratio, which measures how effectively a company converts assets to revenue, is calculated by dividing revenue by the average total assets. The working capital cycle also shows how effectively a company manages its short-term cash flow.

Rates of Return

The balance sheet can be used to evaluate how profitably a business earns revenue. To calculate return on equity (ROE), divide net income by shareholders’ equity. Net income is divided by total assets to determine the return on assets (ROA). To determine the return on invested capital, divide net income by debt plus equity (ROIC).