TDS - How to Pay Your TDS Online | A Step By Step Guide

Tax Deduction at Source (TDS)

As per the Income Tax Act, any taxpayer must pay a proportionate tax amount at a defined rate as a Tax Deduction at Source (TDS). It is one of the methods used by the Central Board of Direct Taxes to collect income tax under the Income-Tax Act of 1961. The Income-Tax Act requires an individual or firm to deduct a particular proportion of the money before making a full payment towards salaries, professional services, contractors, interests, and any other income as defined by the Income-Tax Act. This Guide to Paying TDS Online can help you comprehend the entire process.

The deducted sum must be deposited with the government within the time frame specified by the law. Many individuals and businesses found it difficult to pay TDS online. Every month, the arduous task of filing TDS was exhausting and time-consuming. TDS deposits to the government were made in person at authorised offices. TDS payments are no longer difficult to make. It is now simple because the entire process has been computerised and the payment mechanism has been made online.

The online approach is straightforward and efficient. A PAN and TAN number are required for any individual or company who deducts TDS. A TAN is a 10-digit alphanumeric number assigned to a person or company who deducts TDS. You cannot make payments online or offline unless you have a valid TAN. To deposit TDS, you must first register on the income tax website TIN NSDL PORTAL. They will issue a username and password after successful registration.

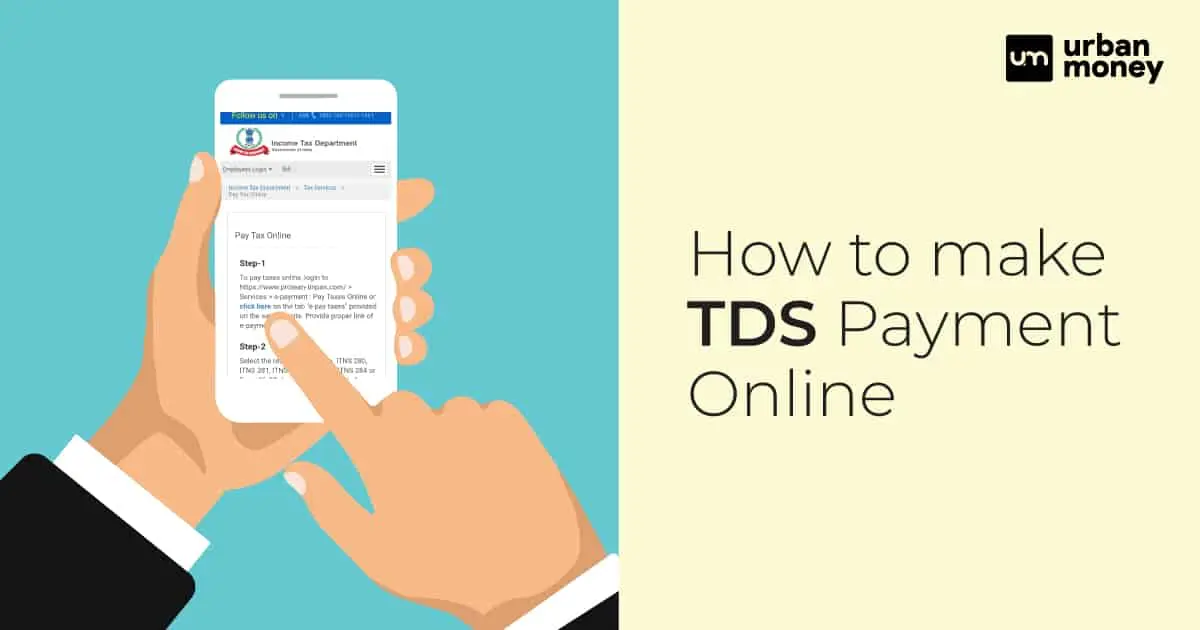

How to Pay TDS Online

To begin, keep all TDS data in a software format.

It should include the following items:

- Deductions have been made under many headings.

- The tax amount for each individual or organisation.

- Details on the fiscal year and the assessment year.

- PAN details.

- Tan accents.

- Keep track of your internet banking information and payment options such as debit and credit cards.

Online process

- When you open the website, you will be prompted to enter your user name and password in order to log in.

- It takes you to the CHALLANS page, where you can find many varieties of CHALLANS.

- TDS CHALLAN 281 must be selected from the list of CHALLANS. It is intended for both individuals and businesses.

- You must complete the details on challan ITNS 281.

- Choose the appropriate part for the taxpayer’s information and whether it is an individual or a business.

- Select a payment method payable by the taxpayer or a periodical assessment.

- Select the type of payment, such as TDS on salary. The numerous categories and tax percentages are listed at the end of the Guide to Paying Your TDS Online.

- Select your payment method. It has the option of using Net Banking or a taxpayer’s Debit Card.

- To validate, enter your TAN information. You will be permitted to proceed after successful verification confirmation.

- Give the assessment year of TDS paid.

- Provide the requested information, such as your address and contact information.

- Enter the captcha code carefully and click proceed.

- It takes you to the confirmation page. Check all of the information you’ve entered. If everything is in order, move to the next page to make payments. You will be directed to the banking page.

- To pay, log in to net banking or another means of payment.

- After successful TDS payment, a receipt with the Challan Identification Number (CIN) will be displayed. It will include payment bank details as well as the collecting bank’s Bank Branch Code, as well as the date of the created Challan. You can save it to your computer and use it later.

The receiving bank sends payment information to the Tax Information Network (TIN) via OLTAS (Online Tax Accounting System). It allows the Income-tax Department to get information on taxes paid by bank transfer.

The Advantages of Paying TDS Online

- Online TDS payment provides advantages such as instant confirmation, real-time status, and online receipts.

- This saves both time and money.

- It is possible to avoid the hassle of keeping physical and tangible records.

- Overwriting and illegible handwriting are examples of errors to avoid.

- Receive instant payment confirmation.

- You can pay at any time. 24/7

- Make a payment from any location.

- At any time, the records can be retrieved quickly.

- quicker and safer.