When a company’s financial statements have been produced, they must be evaluated. Ratio Analysis becomes one such method for analyzing and assessing a company’s financial condition. It enables stakeholders to make good use of the accounts and truly grasp a company’s actual financial position.

Ratios are a comparison of 2 figures in relation to one another. Likewise, in finance, ratios are a relationship of two figures, or more precisely, two accounts. As a result, two numbers obtained from the financial report are evaluated and provide us with a better interpretation of them.

One thing to remember would be that ratio analysis should only be intended to analyze figures that make some sense and provide us with a deeper view of the financial statement. It is best to avoid comparing random financial accounts.

Objectives of Ratio Analysis

It is crucial for every shareholder of an organization to view the financial statements as well as other financial details. As a result, ratio analysis becomes an important method for financial analysis & management. Let’s all glance at some of the purposes that ratio analysis serves.

Must Read – Advantages & Limitations of Ratio Analysis?

1] Measure of Profitability

Each organization’s ultimate objective is profit. How do you decide whether this has been a positive or poor figure if I assume ABC corporation made 5 lakhs of profit previous year? Purpose for measuring profitability, given by ratio analysis, is necessary. The gross profit ratios, the net profit ratio, the expense ratio, etc. calculate the business’s revenue. Management may use these ratios to identify and strengthen weak points.

2] Evaluation of Operational Efficiency

Some ratios reflect a corporation’s level of efficiency in managing its wealth as well as other resources. To prevent needless costs, it is critical that funds and financial resources be managed and used effectively. Turnover and efficiency ratios will highlight any asset mishandling.

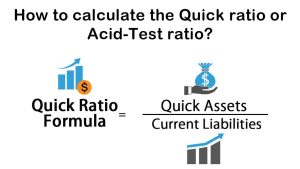

3] Ensure Suitable Liquidity

Any business must ensure that any of its reserves are liquid in case it wants capital right away. As a result, ratios like the Current Ratio & the Quick Ratio are used to assess a company’s liquidity. These assist a company in maintaining the necessary degree of short-term solvency.

4] Overall Financial Strength

Many ratios can aid assess a company’s long-term solvency. They assist in analyzing if a company’s assets are under threat or whether the business is over-leveraged. To stop potential liquidation, management must act immediately to correct the circumstance Debt-Equity Ratios, Debt Ratios, and other such ratios are instances.

5] Comparison

To get a greater view of the business’s financial condition and fiscal status, the ratios should be contrasted to industry benchmarks If the organization fails to meet industry demands, management may take disciplinary measures. The ratios could also be compared to earlier years’ ratios to determine the business success. This is referred to as trend analysis.