Section 80D – Medical emergency situations often take place by surprise. It’s always safer to be protected than blindly taking a risk, and it’s no exception when it applies to medical care. A necessity in your investment portfolio, the Government requires you to purchase medical care which helps you to make tax deductions under Section 80D.

Any person or HUF can receive a deduction towards their total income under section 80D for medical insurance premiums incurred in any particular year.

The deduction advantage is valid for not just one’s own health care coverage, but could also be used to purchase a package to protect the partner or your dependent child or parent.

Must Read – What is Section 80CCC?

Deduction available under Section 80D

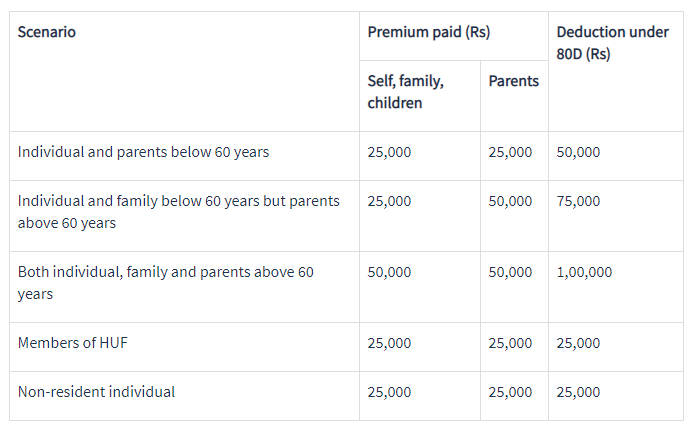

The total deduction permitted under Section 80D previous to Budget 2015-16 was ₹15000, which was raised to ₹25000. In the situation of elderly people, the deduction cap has been raised from ₹30,000 to ₹50,000. The table below indicates the amount of deduction presently applicable to the individual taxpayer for the fiscal year 2019-20 and fiscal year 2020-21 in different situations

Individuals can assert a deduction of max ₹25.000 for self-insurance, partner and minor children. An extra deduction for parents’ insurance is open to ₹25.000 if they are under age 60, or ₹50.000 (according to Budget 2018) if the parents are well above age 60. If the individual and the parent protected by the medical insurance policy are much more than 60 years, the highest deduction which can be rendered under that same provision is to the amount of ₹1,00,000.

Senior citizens are very elderly people over 60 years.

HUF can demand a deduction u/s 80D for any of the participants of the HUF. This deduction would be ₹25.000 if the individual insured is under 60 years and ₹30.000 (raised to ₹50.000 in Budget 2018) if the insured is of 60 years or older.

Important points – Section 80D

- Health benefits premiums paid to brothers, mothers, grandparents, aunts, uncles or just about any relative cannot be counted as a tax benefit deduction.

- The premium charged on account of working children cannot be viewed as a tax benefit.

- In the event of a partial payment from you and a relative, each of you will demand a deduction to the degree that either of you pays.

- The deduction shall be made without any of the service tax and cessation parts of the premium sum being displayed.

- Group health insurance premiums offered by the employer are not available for deduction.