Advantages & Limitations of Ratio Analysis – Ratio analysis may demonstrate how a business has progressed over time as compared to another company in the same market or field.

Although ratios give valuable information into a business they can be used in combination with other indicators to produce a more actual picture of a business’s financial health.

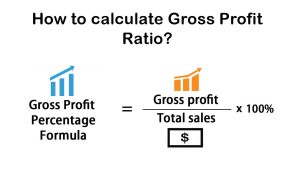

Advantages of Ratio Analysis

If used properly, ratio analysis sheds light on all of the company’s weaknesses while also highlighting some of its strengths. Ratios are basically informants; they direct management’s response to problems that require response. Let’s all glance at a few of the benefits of ratio analysis.

Affordable & Fast Accounting Service In India

- It can help justify or debunk the firm’s funding, investment, and financial judgments. They simplify the financial report into numerical figures enabling managers to measure and analyze the company’s financial situation and the outcomes of their actions.

- It breaks down complicated financial statements and financial details into basic ratios such as operating efficiency, financial efficiency, solvency, long-term positions, and so forth.

- Ratio analysis assists with identifying trouble zones and directing management ‘s awareness to it. Any knowledge is missed in the complicated financial records, and ratios can assist in identifying those issues.

- Makes the firm to compare itself to other companies, industry standards, intra-firm comparisons, and so forth. This would assist the company in properly understanding its financial role in the economy.

Limitations of Ratio Analysis

Although ratios are incredibly useful instruments for financial analysis, they do have certain drawbacks, like.

- To increase their ratios, the company can make any year-end adjustments to their financial reports. And the percentages become nothing more than a gimmick.

- Inflationary price increases are ignored by ratios. Often ratios are measured using historical costs, and they ignore market fluctuations among periods. This will not accurately represent the financial position.

- Accounting ratios totally neglect the company’s qualitative aspects. They are just concerned about the monetary aspects (quantitative)

- The ratios have no common meanings. As a result, companies can use various methods for calculating ratios. Take an example of Current Ratio, in which some companies include all current liabilities and others exclude bank overdrafts from current liabilities when determining the current ratio.

- Accounting ratios may not fix all of the firm’s financial difficulties.