In this post we will learn How to calculate Accounts Receivable Turnover Ratio, Step by step.

Accounts Receivables Turnover indicates how a company utilizes its assets. It is an accounting metric that determines how well a company provides credit and recovers debts on that credit.

The Accounts Receivable Turnover Ratio measures how quickly a business earns credit it has provided to a client. Companies who keep accounts receivable effectively make interest-free lending to their clients, because accounts receivable is cash lent without interest. More the time it takes a company to recover its credit, the more revenue it spends.

A high turnover rate suggests a mixture of a strict lending approach and an efficient collections mechanism, as well as a large number of high-quality buyers. If a business’s turnover ratio is bad, it must begin collecting on unnecessarily old accounts receivable that are locking up cash.

Monitoring receivables turnover will help you determine if you need to raise funds for hiring the collection team and whether turnover is worsening.

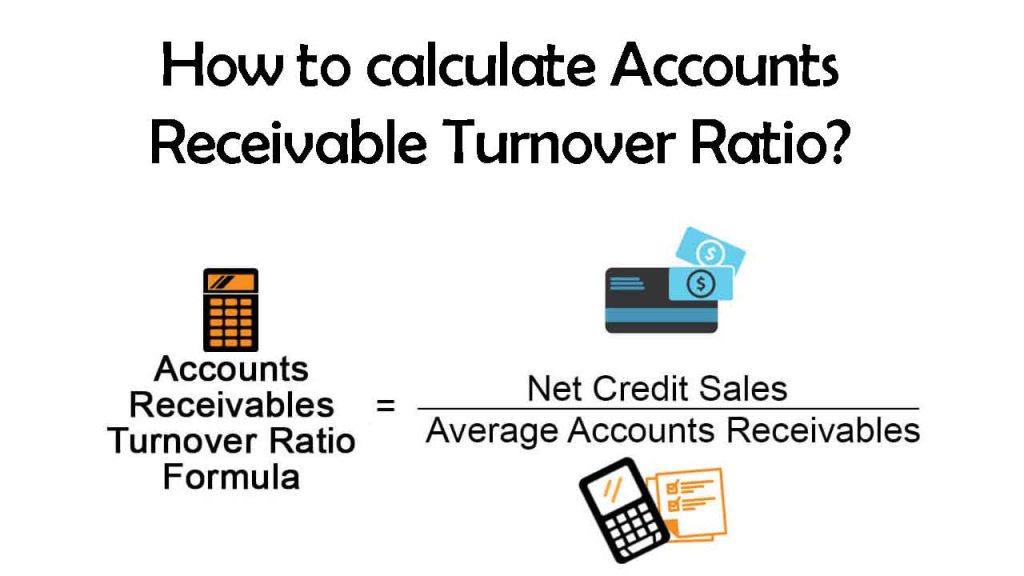

Formula to calculate Accounts Receivable Turnover

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Accounts Receivable (AR) Turnover is calculated by adding the opening and closing accounts receivable to have the average AR for the given year & then dividing it by the net credit sales.

Example – The beginning accounts receivable was 200,000, and the ending balance was 100,000 Net credit sales for the year were 300,000. Based on this information calculated the accounts receivable turnover ratio –

Average Accounts Receivable = 200,000 + 100,000/2

= 1,50,000

Accounts Receivable Turnover Ratio = 300,000/1,50,000 = 2:1

How to Improve Your Accounts Receivable Turnover Ratio

One of the most important things for company owners to do is pay attention on their accounts receivable turnover. Making profits and providing outstanding customer service are vital, but a company cannot function with a negative cash flow. Collecting receivables is a sure way to boost the business’s cash flow

- The more correct and informative your invoices, the easier it would be for the clients to pay the bill. Invoicing on schedule and frequently will often help the business obtain receivables more quickly. If you have a payment scheme in place for your transactions, your clients would find it easier to pay smaller, daily payments rather than one big bill per quarter.

- A positive interaction with your clients can assist you in receiving payment. Clients who are pleased by the products and services they get are willing to pay for them. Small friendly acts, such as a polite call or email to check in, will help both large and small businesses. These little gestures will make a big difference during selection season.

- Using simple payment terms on your bills will help your invoices succeed. Made it very clear that you really want payment in 30 days, so do not hesitate to charge late fees. This fee is typically calculated as a percentage of the initial bill. Consider establishing credit limits or providing payment options for costly transactions.

- Try utilizing cloud-based accounting tools to simplify the billing and receivables processes. Online billing helps you to view your financial records from everywhere and work with your accounting and bookkeeping staff more effectively. Cloud accounting platform helps you to accurately monitor the receivables and cash balance, as well as simplify regular invoices and customer alerts.

- Supplying different payment options for the clients would make it easy for them to suit where their own financial mechanism is. Making your clients’ lives easy would allow you to receive payment more quickly. Receiving online payments via any payment gateway, as well as conventional approaches such as cheque and cash, should be considered.

- The easiest way to avoid dealing with Accounts Receivable (AR) issues is not to have any AR. Although this may not be feasible for all businesses, there are several companies that may allow prepayment before delivering a product or service.

- Payment notices should not only be sent while a payment is overdue. Consider sending a friendly call or email to the clients 10 days prior the invoice is due to inform them that their bill is due. Follow up as soon as the deadline has passed.