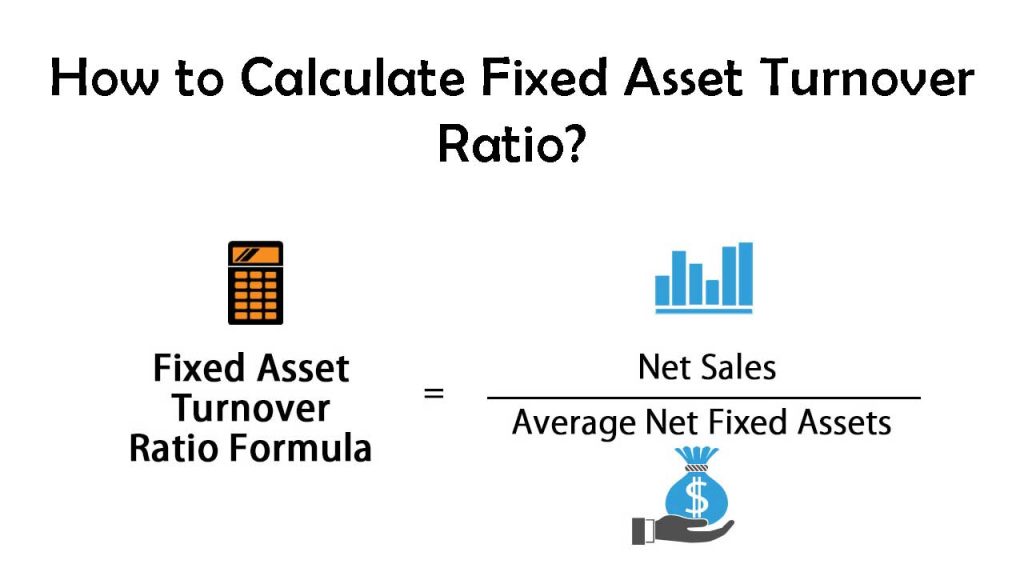

How to Calculate Fixed Asset Turnover Ratio: The fixed asset turnover ratio is an indicator of a business’s productivity and is calculated as a return on fixed assets like land, factory, and facilities. In other words, it evaluates a business’s potential to produce net sales from its machinery and equipment effectively. The formula is written as –

Fixed Asset Turnover Ratio = Net sales/Fixed asset – Accumulated depreciation

Steps To Calculate Fixed Asset Turnover Ratio

The preceding steps will walk you through the process of calculating the fixed asset turnover ratio.

- To begin, take note of the business’s net sales, which are readily accessible as a line item on the income statement.

- The balance sheet will also be used to measure the net fixed assets by averaging the opening & closing net fixed assets. Gross fixed assets & accumulated depreciation could be taken from the balance sheet to measure net fixed assets by subtracting accumulated depreciation from gross fixed assets.

- After this, the fixed asset turnover ratio is calculated by dividing net sales by net fixed assets.

Example – Abc is a manufacturing company where net sales during the year was 1,00,000, their opening fixed assets are 65,000 and closing fixed assets are 35,000. Calculate Fixed Asset Turnover Ratio.

Net Fixed Asset = 65,000 + 35,000/2 = 1,00,000/2

= 50,000

Fixed Asset Turnover Ratio = Net sales/Fixed asset – Accumulated depreciation

1,00,000/50,000 = 2

Fixed Asset Turnover Ratio of ABC ltd is 2:1

Must Read – Advantages and Limitation of Fixed Asset Turnover Ratio

Uses

The fixed asset turnover ratio is crucial through the perspective of an investor and lender, who use it to determine how effectively a firm uses its machinery and equipment to produce sales. This definition is beneficial for investors since it could be utilized to calculate the return on their fixed-asset investment.

Creditors, on the other hand, utilize this ratio to determine if the business has the ability to produce enough cash flow from the freshly acquired equipment to repay the loan that was used to buy it. This ratio is often seen in the construction industry, where businesses make massive and costly machinery acquisitions.

That being said, senior management of any business rarely uses this ratio as they have insider knowledge regarding sales, equipment acquisitions, and other such data that outsiders can’t have access to. The management tends to calculate the return on the purchases using more accurate and precise data.

If a corporation has so much invested in its stock, its operating capital would be too large. Or else, if the firm does not spend sufficiently in its assets, it risks losing sales, that would damage its profits, free cash flow, and, inevitably, stock price.

It is possible to do so by matching the business’s ratio to that of other firms in the very same sector and analyzing how often others have invested in comparable investments. Furthermore, the business will watch how much it invests for each asset each year and create a trend to compare the year-on-year pattern.