In this post you will learn how to calculate the current ratio – step by step.

The current ratio is a widely known business metric for evaluating a firm’s short-term liquidity in relation to existing assets and outstanding liabilities. To put it another way, it measures a firm’s potential to raise sufficient cash to pay off all of its obligations when they become due. It’s a metric that is used all around the world to calculate a firm’s total financial efficiency.

Although the optimal current ratio range differs based on the business nature, a ratio of 1.5 to 3 is typically regarded safe.

A ratio of less than one may imply a firm’s liquidity issues, but the firm could avoid a serious shortage if it can acquire other ways of funding. A ratio of more than three indicates that the firm is not effectively utilizing its current assets or handling its working capital.

Current Ratio Calculate with Example

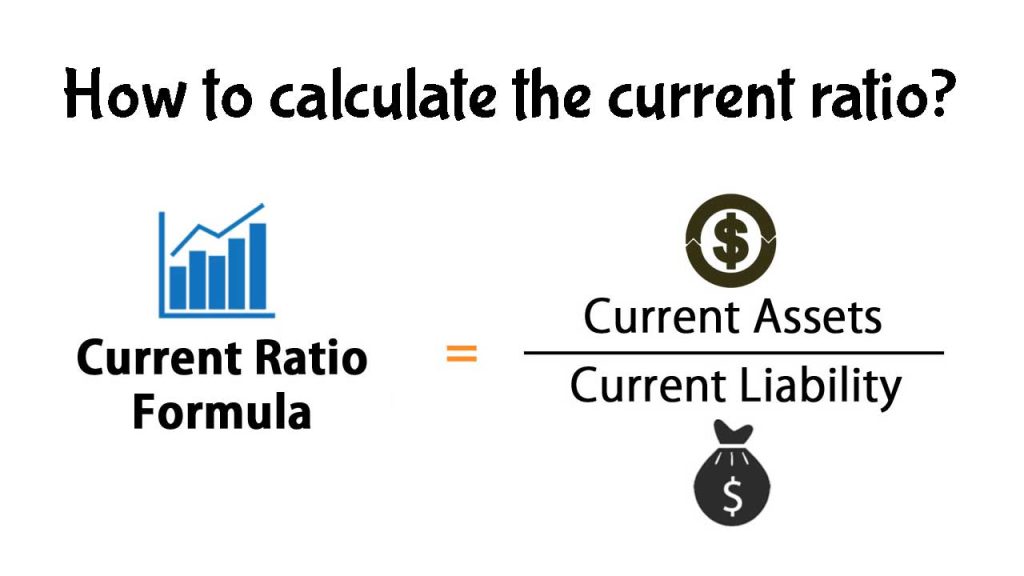

It is measured from 2 basic figures seen on a firm’s balance sheet which it publishes in its financial statement i.e. current assets & current liabilities. The current ratio is calculated using the following formula:

Current Ratio = Current Assets /Current Liabilities

What are Current Assets?

Current assets are the sum of all assets which is displayed on the firm balance sheet and can be converted into cash in a year. Like –

- Cash and cash equivalents

- Prepaid expenses

- Inventory, etc

For example, Suppose in the balance sheet (in cr) of Reliance Pvt Ltd. For FY 2020, the company mentions its cash in hand as 100, Prepaid expenses as 50 and inventory of 150. So the Reliance current assets for the period 2020 would be 300 crores.

The total for current assets differs from that of total assets calculation, which comprises net property, plant & machinery, Lands & Building, long-term investments, intangible assets, etc.

What are Current Liabilities?

It is shown on the liabilities side of a firm’s balance sheet which represents short terms loan (of max 1 year). Like –

- Short-term debt

- Accounts payable

- Accrued liabilities etc

For example, Suppose in the balance sheet (in cr) of Reliance Pvt Ltd. For FY 2020, the company mentions its short term loan as 10, Accounts payables as 20 and Accrued liabilities of 50. So the Reliance current liabilities for the period 2020 would be 80 crores.

Calculating Current Ratio

If ABC ltd has –

Cash = ₹6 Crores

Marketable securities = ₹3 Crores

Inventory = ₹7 Crores

Short-term debt = ₹8 Crores

Accounts payables = ₹2 Crores

Current Assets = 6 + 3 +7 = 16 Crores

Current Liabilities = 8 + 2 = 10 Crores

Current Ratio = Current Assets /Current Liabilities

= 16/10 = 1.6

The current ratio of ABC ltd is 1.6:1. A ratio of higher than one indicates that the business is financially healthy. There seems to be no maximum limit on how much is “excessive,” since it varies by business; although, a very high current ratio can mean that a firm is hoarding cash instead of using it in expanding its operations.