How to Calculate Interest Coverage Ratio – The ICR assesses a business’s potential to charge interest on its accrued obligations. Creditors, lenders, and investors utilize this metric to assess the cost of lending money to a firm. A higher ratio means that a firm will recoup its interest cost multiple times over, whereas a low ratio implies that a business is likely to fail on its debt payments.

Monitoring the ICR on a trend line will help you identify cases where a business’s earnings or debt load are causing a declining trend in the ratio.

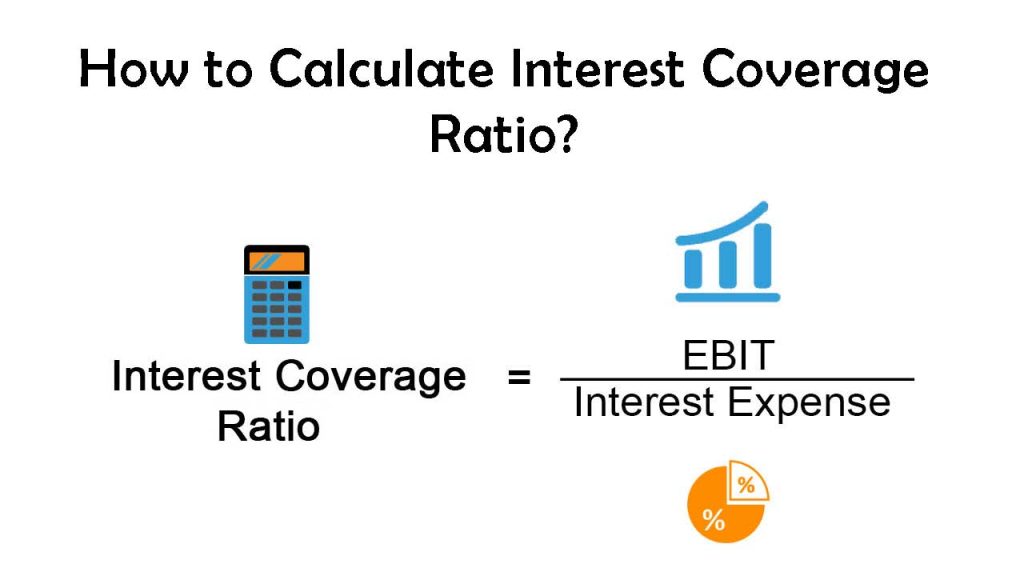

Interest Coverage Ratio Formula

Interest coverage ratio = Earnings Before Interest and Taxes/Interest expense

The formula utilizes EBIT rather than net income. Earnings before interest and taxation were simply net income after deducting interest and tax expenditures. We utilize EBIT rather than net income in the equation if we want a fair reflection about how much debt the corporation can afford to pay. If we were using net income, the equation will be messed up as interest expense would’ve been counted twice, and tax expense will vary depending on the amount of interest deducted. To prevent this issue we simply use earnings or revenues before interest and taxes are deducted.

You should also keep in mind that this calculation could be used to calculate any interest time. Monthly or partial year figures, for instance, could be determined by dividing EBIT and interest cost by the number of months to be computed.

Interest Coverage Ratio Analysis

Evaluating a coverage ratio could be difficult when it is heavily influenced by how much exposure the borrower or lender is able to take. A bank may be more secure with one amount than another, based on the appropriate risk limits. The fundamentals of this calculation remain constant.

Even if a high ICR is preferable, the optimal ratio varies by sector. With all that said, let’s take a glance at some of these indicators for analyzing this financial statistic.

- A ratio lower than one means that the company is unable to produce sufficient money to cover its interest payments.

- A ratio less than 1.5 means that the business will be unable to cover the interest on debt.

- A low ratio implies a greater debt burden and a higher risk of default or bankruptcy. It also has a detrimental impact on a company’s goodwill.

- A ratio of 2.5 to 3 means that the company’s existing profits would be sufficient to cover off the accrued interest on debt. This could, furthermore, be an indication of the business’s internal policies or a statutory obligation to retain a higher ratio.