UPI Payments To Charge Fees

The Center has supported cashless transactions ever since the government began to demonetise currency in 2016. Despite the fact that cash is still king in today’s world, internet payments have considerably grown.

The Unified Payments Interface reached its zenith in 2022 with a record-breaking 782 crores in transactions. (UPI). In December, UPI transactions surpassed a new high of Rs 12.82 lakh crore.

According to data released by the National Payments Corporation of India (NPCI), which oversees retail digital payments, the volume of transactions increased by 7.12% in December compared to November, while the value of transactions increased by 7.73% over the same time frame. In October 2022, payments made using UPI had hit the Rs 12 lakh crore milestone.

Both the quantity and the value of UPI transactions have drastically increased since the start of the pandemic and lockdowns two years ago. Experts claim that UPI’s upward trend is a reflection of both the general economy’s recovery and consumers’ increasing use of digital payment options for everyday purchases.

UPI is currently the most widely used payment method in India for customers to instantly move money between bank accounts via their mobile devices. PPIs, on the other hand, are virtual wallets that enable internet payment and money saving. There are PPIs like PhonePe, Paytm, and GPay accessible in India.

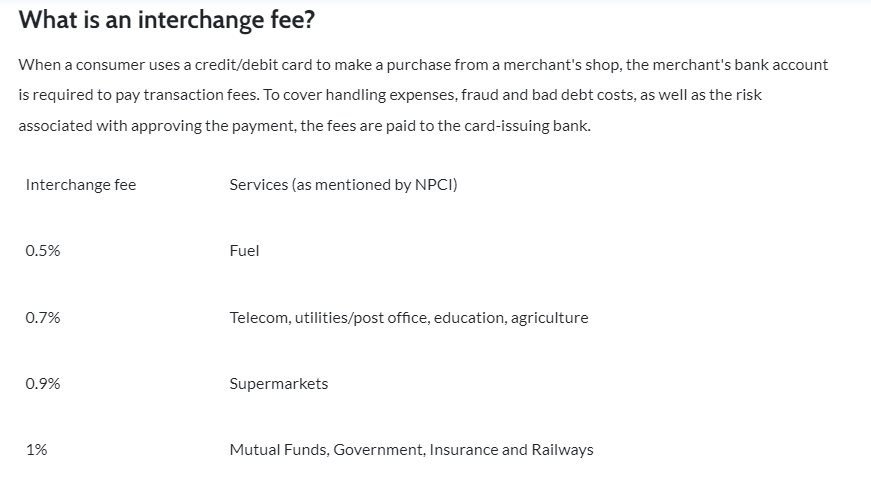

The cost paid by one bank when carrying out a transaction with another bank is known as an interchange fee. In the case of UPI transactions, the bank of the merchant (the individual or company who gets the payment) gives the bank of the payer the interchange fee. (the person making the payment).

Merchant Unified Payments Interface (UPI) transactions will be subject to an extra interchange charge of up to 1.1% beginning on April 1, according to a recent statement from the National Payments Corporation of India (NPCI). Any transactions with prepaid payment instruments (PPIs), such as wallets or cards, that sum more than Rs 2,000 are subject to these fees.

UPI payments made to small and big offline and online retailers alike will be subject to the interchange fee. However, not all transactions will be charged the same fee.

The NPCI has given the interchange charge range that may be imposed in accordance with applicable caps for a number of merchant types.

Who is going to pay?

For instance, the merchant will pay PhonePe the appropriate interchange fee if a customer uses UPI (Paytm or Google Pay) to make a PPI payment in-person or online and the QR code says “PhonePe”.

The user’s bank receives the interchange charge for processing UPI transactions from the merchant’s bank (the person or company getting the payment).

Conclusion

Now, only small sums are involved in the largest UPI transactions. The NPCI asserts that by paying PPI firms more money for pushing UPI transactions, UPI’s average transaction value can rise and the cost of India’s payment systems as a whole can be reduced.

The NPCI asserts that the suggested interchange charge is in accordance with their recommendations, while the Council on Payments and Market Infrastructures, the World Bank, and others support interchange fees of up to 1.15% for UPI transactions.