A mutual fund which invests in 100 stocks & substitutes 50 stocks in a year, for instance, has a turnover ratio of 50%. Few funds keep their stock positions for much less than a year, implying that their turnover rates surpass 100%.

That being said, just when a portfolio’s turnover ratio approaches 100% does not imply that any individual holding has indeed been substituted. The ratio attempts to represent the percentage of stocks which have increased in a single year.

What is the Turnover Ratio?

The turnover ratio, also known as the turnover rate, was its proportion of a mutual fund’s or even other portfolio’s assets that were substituted in a specified year.

Types of Turnover Ratio

Must Read – What is Solvency Ratio?

- Inventory Turnover Ratio

Inventory turnover is a ratio that shows how often business’s inventory is sold and substituted throughout a given timeframe. The days in the cycle will then be divided by the inventory turnover equation to determine how long it would take to sell the inventory on hand.

Determining inventory turnover may assist companies in making smarter pricing, processing, selling, and buying new inventory choices.

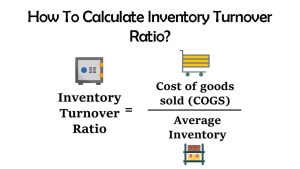

Formula to Calculate the Inventory Turnover Ratio

Inventory Turnover Ratio = Sales/Closing Inventory

- Debtors Turnover Ratio

The Debtors Turnover Ratio demonstrates how instantly credit transactions are turned to money. This ratio assesses a company’s ability to manage and collect on credit extended to consumers.

One factor to keep in mind is that most businesses use gross revenue rather than net sales, that results in an inflated turnover ratio. As a result, just net credit transactions can be considered when determining this ratio.

Formula to Calculate the Debtors Turnover Ratio

Debtors Turnover Ratio = Net Credit Sales/Average Account Receivable

- Average Collection Period

The Average Collection Period is a part of the Financial Ratio. You can use it to know about the time it requires to receive payments by the customers in terms of Accounts Receivable. It is important to know whether an organization depends heavily on cash flows.

Formula to Calculate the Average Collection Period

Average Collection Period = Average Debtors/Credit Sales

- Total Assets Turnover Ratio

The asset turnover ratio calculates the value of profits or income of a business according to its asset value. The asset sales ratio could be used as a measure of the effectiveness of a business in generating revenues by using its inventory.

If the turnover of assets is greater, an enterprise generates income from its assets more efficiently. In contrast, if an organization has a poor turnover level of inventory, it means it can not use its assets effectively to attain sales.

Formula to Calculate the Total Assets Turnover Ratio

Total Assets Turnover Ratio =Net Sales/Total Assets

- Fixed Assets Turnover Ratio

Analysts usually use the fixed asset turnover ratio (FAT) to determine operational performance. This productivity ratio evaluates net sales to fixed assets and assesses a firm’s potential to achieve net sales from its fixed-asset investments, which include land, factory, and machinery.

Formula to Calculate the Fixed Assets Turnover Ratio

Fixed Assets Turnover Ratio = Sales/Net Fixed Assets

- Capital Employed Turnover Ratio

The Capital Employed Turnover Ratio demonstrates how effectively profits are produced from the company’s capital employed. This ratio assists investors and borrowers in determining a company’s ability to produce profits from the capital employed and serves as a primary deciding factor in borrowing more funds to the demanding firm.

Formula to Calculate the Capital Employed Turnover Ratio

Capital Employed Turnover Ratio =Sales/Capital Employed