Details Benefits Eligibility Application Process Documents Required What is MSME Loan Details An MSME loan is a financial instrument intended primarily for micro, small, and medium-sized businesses in...

Details Benefits Eligibility Application Process Documents Required National Livestock Mission (NLM) Details The National Livestock Mission (NLM) is a government effort that aims to assist and promote...

The Ultimate Guide on How To Apply For CGTMSE Loan Introduction If you are an entrepreneur with a desire to start a manufacturing company, you understand how important it is to secure the correct...

Introduction New sections were inserted in the Finance Bill, 2021, to deduct TDS (tax deducted at source)/collect TCS (tax collected at source) at higher rates when an amount is paid to certain...

what is TDS Deduction ? The Introduction of TDS Deduction. TDS Deduction (Tax Deducted at Source) is an Indian tax collection method in which the deductor (person responsible for making payment) is...

What is TDS on Rent? TDS on rent is an income tax collection system in India in which the tenant deducts a specified percentage of tax from the rent payment given to the landlord and deposits it with...

Details Benefits Eligibility Application Process Documents Required MINISTRY OF TEXTILE Details The Ministry of Textiles is a significant branch of the Indian government, in charge of developing and...

Details Benefits Eligibility Application Process Documents Required Mukhyamantri Laghu Udyog Protsahan Yojana (MLDPY) Details The Mukhyamantri Laghu Udyog Protsahan Yojana aims to promote...

Effects of Non-registration of a Partnership Firm -The Companies Act of 2013 emphasises that registration is the most important step for any organisation to do in order to reclassify itself as a...

How to Register a Company in USA From India? Globalization is necessary for business success. The desire to start a business in the United States is widespread among businesspeople. Because there are...

Details Benefits Eligibility Application Process Documents Required National Livestock Mission (NLM) Details The National Livestock Mission (NLM) is a government effort that aims to assist and promote...

Details Benefits Eligibility Application Process Documents Required National Horticulture Mission Details The Mission for Integrated Development of Horticulture (MIDH) of the Government of India...

Details Benefits Eligibility Application Process Documents Required Central Institute for Horticulture (CIH) Details The Central Institute for Horticulture, established in 2006 and based in Nagaland...

Details Benefits Eligibility Application Process Documents Required International Centre for Environment Audit and Sustainable Development (iCED) Details The “International Centre for...

Details Benefits Eligibility Application Process Documents Required Coconut Development Board (CDB) Details The Ministry of Agriculture and Farmers’ Welfare, Government of India, oversees the...

Details Benefits Eligibility Application Process Documents Required Agri-Clinics And Agri-Business Centres Scheme Details A welfare scheme by the Ministry of Agriculture and Farmers’ Welfare was...

Details Benefits Eligibility Application Process Documents Required Mission on Integrated Development of Horticulture Details Horticultural products such fruits, vegetables, cocoa, cashew, coconut...

Details Benefits Eligibility Application Process Documents Required National Beekeeping & Honey Mission Details a) Honey Mission Promoting holistic growth of beekeeping industry for income &...

Details Benefits Eligibility Application Process Documents Required Paramparagat Krishi Vikas Yojana Details Paramparagat Krishi Vikas Yojana aims at supporting and promoting organic farming, in turn...

Details Benefits Eligibility Application Process Documents Required National Mission on Natural Farming Details National Mission on Natural Farming aims at creating institutional capacities for...

Details Benefits Eligibility Application Process Documents Required Agricultural Marketing Infrastructure Details The scheme envisages value addition and processing at farmers level so as to enhance...

Details Benefits Eligibility Application Process Documents Required Krishi Unnati Yojana – MOVCDNER Details Realizing the potential of organic farming in the North Eastern Region of the country...

Details Benefits Eligibility Application Process Documents Required National Horticulture Board Details The National Horticulture Board (NHB) is an Indian organization that was founded in 1984 to...

Details Benefits Eligibility Application Process Documents Required National Bamboo Mission Details As a result of this historic amendment, regulations pertaining to forest products do not apply to...

The One Person Company Registration Act, of 2013 fundamentally altered Indian corporate law by adding numerous new ideas. One such game-changer was the emergence of the notion of the One Person...

Advice from a Treasury Recruiter on Networking What is a Treasury Recruiter? A Treasury Recruiter is a specialist who specializes in sourcing, assessing, and hiring candidates for treasury-related...

Understanding Capital Gains Tax in India and its Effects What is the Indian Capital Gains Tax? Income from capital gains refers to any profit or gain derived from the sale of a “capital...

Understanding Indian Income Tax Deductions and Exemptions What are tax deductions? Tax deductions are claims made to lower your taxable income that result from different investments and expenses...

A Complete Guide to Income Tax Slabs in India What Is the Income Tax Slab? In India, the Income Tax applies to individuals using a slab system, with different tax rates assigned to different income...

Understanding Nfts And Their Financial Impact What is Nfts? Understanding Nfts, or Non-Fungible Tokens, are one-of-a-kind digital assets that use blockchain technology to indicate ownership or proof...

The Impact of Inflation on Personal Finances Introduction Inflation is defined as the progressive increase in an economy’s overall price level of goods and services over time. When there is...

Exploring the Potential of Decentralized Finance Introduction Exploring Decentralized Finance (DeFi) has the potential to transform traditional financial institutions by combining blockchain...

Tax Benefits Available to Senior Citizens Introduction The following blog post discusses the income tax benefits available to senior citizens in India. Under the Income Tax Act, a person...

When Is ICDS Applicable While Filing For ITR? 2023 Introduction Filing an Income Tax Return has a significant legal significance in a paid or non-salaried individual’s tax records, as it upholds...

Adjustment Towards Disallowance in Terms of Section 36, are Permissible Under Scope of Section 143 Introduction Section 36 of the Income Tax Act provides for specific deductions and exemptions for...

E-Filing ITR for a Sole Proprietorship – A Step-by-Step Guide Introduction Partnerships and large enterprises must pay tax on their earnings. As a result, a sole proprietorship, like them, must...

IT Everything You Need to Know About Rental Income Taxation in India What is Rental Income? Rental income is the revenue received by an individual or company from the rental or leasing of a property...

How to Build an Emergency Fund for Financial Security Introduction A financial emergency fund is a collection of savings intended to cover unexpected bills or financial emergencies. It acts as a...

How to Calculate ITR HRA Exemption Introduction Consider that you spend $15,000 per month in rent in Bangalore. Your base monthly salary is 70,000, plus a health reimbursement allowance of 20,000. In...

7 Ways to Save Money on Crypto Taxes in India by 2023 – ITR Guide Introduction In income tax purposes, cryptocurrency is classified as “property.” And the IRS considers it a capital...

What Is The Penalty for Failure to File a Proprietorship ITR? Introduction The deadline for reporting ITR is before the end of the fiscal year on July 31st. To ensure that everyone files their ITR...

How To Claim TDS Refund Online Introduction TDS is a type of advance tax paid to the central government on a regular basis by the deductor. After filing their ITR, the deductee can seek a tax...

Form 16 & Form 16A – All Differences You Need To Know Introduction Filing income tax returns above a certain threshold is required. Form 16A is crucial since it serves as financial...

GST Registration Certificate Uses, Process to Download Introduction The type of registration received determines the validity of the Goods and Services Tax Registration Certificate. If the certificate...

The Income Tax Act, Section 6 Introduction Section 6 of the Income Tax Act provides provisions about residence in India. Individuals must be aware of their residential status for the prior year when...

Introduction: A Cooperative Housing Organisation (CHS) is a collection of people that work together to acquire and develop land for residential use. CHS provides low-cost housing to its members, who...

Introduction If you intend to do business in or with the Netherlands, you should be aware of the country’s Value Added Tax (VAT) system. VAT is a tax on the value added to products and services...

Income Tax Department issues clarification on PAN-Aadhaar linking Introduction Through its official Twitter account, the Income Tax Department recently provided major clarification regarding the...

Introduction One of the most important advantages provided in a salary slip for people earning a salary is the HRA (House Rent Allowance) for Claim HRA in ITR. If you earn a salary and rent your...

GST Notices What are Notices & Types of Notices Introduction of GST Notice? When there is noncompliance with GST laws and regulations, tax authorities will send GST notices to taxpayers, which are...

What exactly is HRA? HRA is the House Rent Allowance that salaried employees receive from their employers. HRA is a typical instrument that can be utilised to claim income tax exemption when filing an...

What is Section 80D of Income Tax Act? Introduction Section 80D allows any individual or HUF to deduct medical insurance premiums paid in a given year from their total income. This deduction is also...

Which ITR Form Must Sole Proprietorship Businesses File? Introduction A sole proprietorship, like other incorporated businesses such as partnerships and corporations, is required to pay taxes on its...

How Do We Fill Out Bonus Information in ITR? Introduction Festivals are anticipated by the majority of individuals for a variety of reasons. In the case of salaried employees, it is for the bonus that...

Sovereign Gold Bonds Features, Advantages, Income tax and GST Introduction SGBs are government securities that are expressed in kilos of gold, allowing individuals to invest in gold without the hassle...

The Finance Act of 2022 created a brand-new concept of an updated return, which permits taxpayers to continue updating their ITRs after filing for less than two years, provided that taxes have been...

ITR Form Must Sole Proprietorship Businesses File? 2023 Introduction A sole proprietorship, like other incorporated businesses such as partnerships and corporations, is required to pay taxes on its...

How to Claim LLP ITR Deductions and Credits? Introduction Filing income tax returns can be a stressful chore for any firm, and it is no different for LLPs. As an LLP, you must file an income tax...

How to File a Revised TDS Return Introduction TDS, or Tax Deducted at Source, is a regulatory system for tax collection in which tax is deducted from a person’s taxable income by the person...

New Tax Rules For Leave Travel Concession- Here’s How To optimise This Holiday Season Introduction Employees can claim a Leave Travel Concession, which is an exemption from income tax, for costs...

What Is Tax Deducted At Source & TDS Certificate? What does TDS stand for? TDS stands for Tax Deducted at Source. According to the Income Tax Act, if an employee’s payment exceeds...

What Information Will Be Required For An Income Tax Audit? Introduction The country has several rules and regulations. Some of them manage multiple types of audits, such as counting cost audits, stock...

What Is GST Cancellation and Why Is It Important in 2023? GST Cancellation GST Cancellation refers to the termination of GST registration by the taxpayer or tax authority. Once revoked, the taxpayer...

How Does an Audit Work Under the GST Regime? Introduction: A GST Audit is performed to ensure the correctness of a professional’s reported turnover, taxes paid, and input tax credit...

1. Introduction of Freelance Taxation in India: Salaried employees make it simple to file their income tax returns, or ITRs. The HR department is in charge of sending out Form 16 notifications and...

TDS Payment Online Applicability-Advantages-Procedure & Penalty 2023 The deductor or business entrusted with making a TDS Payment Online to the deductee should deduct the tax amount before...

Is Trade License Mandatory for GST Registration? The short answer is no. It is necessary to operate a business within a specified municipal limit, however it is not required under the GST framework...

RBI has Announced a 6.97% Interest Rate on 2024 Floating Rate Bond The Reserve Bank of India (RBI) has set a competitive interest rate of 6.97% on the Floating Rate Bond for 2024. This news presents...

What is Double Taxation Avoidance Agreement – DTAA? Introduction The Double Taxation Avoidance Agreement is a treaty that two countries have signed. The agreement is signed to make the country...

Taxation for Freelancers in India Should They File TDS Returns? Introduction Yes, freelancers must submit TDS (Tax Deducted at Source) returns if they deducted tax at the source from payments made to...

What are the Types of Income Tax Notices? Introduction We are frequently concerned when we receive Income Tax notices, yet these notices always serve a purpose. Information is included in some income...

Why should you submit an ITR for a sole proprietorship in India? Introduction Companies and limited liability partnerships are registered in India; ITR for sole proprietorship: Proprietorship...

Income Tax Act Section 194 DA What Is Section 194DA of the Income Tax Act? Section 194DA of the Income Tax Act gives instructions for calculating, exempting, and collecting TDS on insurance...

Why is it Necessary to Verify GSTIN or GST Number? The Indian government imposed the Goods and Services Tax (GST) on July 1, 2017, in order to streamline the country’s tax structure. The main...

TDS -Tax Deducted Source | Under Goods & Services Tax 2023 What does Tax Deducted at Source (TDS) in GST mean? TDS in GST refers to the tax deduction made by the recipient of goods or services at...

How is the Salary Arrears Taxed? What Is Salary Arrear? Salary arrears are unpaid wages. This sum has not yet been paid to the employee. Every employer makes every effort to pay employees on time...

TDS – How to Pay Your TDS Online | A Step By Step Guide Tax Deduction at Source (TDS) As per the Income Tax Act, any taxpayer must pay a proportionate tax amount at a defined rate as a Tax...

How Can I Search GST Number Online Through PAN? What exactly is GSTIN? The Goods and Services Tax Identification Number (GSTIN) is a one-of-a-kind (UIN) number assigned to each taxpayer who is...

TDS and TCS Under GST What exactly is TDS under GST? TDS (Tax Deducted at Source) is a way of collecting tax at the point of payment. TDS is levied in India under the Goods and Services Tax (GST)...

Decoding CBDT’s Introduction of Form 10-IEA for Opting the Old Tax Regime Introduction The Central Board of Direct Taxes (CBDT) has just introduced Form 10-IEA, which is a must-have for business...

What Is Professional Tax? How Much Does Professional Tax Cost? What Exactly Is Professional Tax? If you are a salaried professional with a regular income, you are required to pay a professional...

Section 194J TDS on Professional or Technical Fees TDS (Tax Deducted at Source) is a type of indirect tax levied on an individual’s earnings. In basic terms, when any individual or corporation...

MPTAX Professional Tax Registration in Madhya Pradesh 2023 MPTAX: Madhya Pradesh Professional Tax Registration The professionals and members are liable to the State Government’s professional...

Filing income tax returns is a must for everybody who earns a living in India. It is a legislative obligation that ensures the government can appropriately estimate people’ tax liabilities and...

Sole Proprietorship ITR Instructions Sole proprietorships, like any other incorporated company, such as a partnership or a corporation, must pay taxes. In the legal sense, ownership is recognised as...

What actually is ITR? The income tax return is the form on which an assessee reports information about his or her income and taxes with the Income Tax Department. ITR 1, ITR 2, ITR 3, ITR 4, ITR 5...

UPI Payments To Charge Fees The Center has supported cashless transactions ever since the government began to demonetise currency in 2016. Despite the fact that cash is still king in today’s...

What Is Imprest Imprest is a cash account that a business depends on to pay for regular, small expenses. Cashiers periodically refill the funds in the imprest, while keeping a set balance. The word...

Trademark & Patent under Startup India initiative – In India understanding of intellectual property rights (IPR) is rising quickly, and the government has acknowledged the need to promote...

Absolute Grounds for Refusal of Trademark Registration A trademark registration application may be rejected on absolute or definable grounds, such as the presence of competing marks, well-known marks...

Who can be appointed as Statutory Auditor? Who can be appointed as Statutory Auditor? – A person chosen to confirm the accuracy of the company’s accounting records is known as a statutory...

How One can Register a Digital Marketing Agency How One can Register a Digital Marketing Agency – You must first register your business with each of the available business structures in India...

Colour Trademark in India Colour Trademark in India – 2017 Trademark Rules The new regulations that will create the new system include provisions for colour marks. A colour mark is a...

What Happens If I Don’t File My ITR? What happens if I don’t file my ITR? – An income tax return (ITR) is a form used to report your income and taxes to the income tax department. ITRs...

GST State Code List What is The GST State Code? GST State Code List – A state code is assigned to each Indian state. This aids in determining the location of a company or taxpayer. Because...

How To Open A Small Business In India? How To Open A Small Business In India – According to MSME estimates, India has about 80 million employees who work for roughly 36 million SMEs. More than...

Anti Profiteering Under GST Anti Profiteering Under GST – GST Anti-Profiteering Provisions The economic sectors of numerous nations are covered by the GST system. Both Australia’s and...

FDI In Private Limited Company FDI In Private Limited Company – Connectivity improvements and regulatory freedom have benefitted globalisation and the unrestricted flow of money across...

Trademark Registration In India Trademark Registration In India – A trademark is a distinctive identity that distinguishes your organization, product or service from the competition. Your...

Nidhi Company Registration Nidhi organizations are formed to lend and borrow money on behalf of all members. This is built on the premise of mutual benefit and instills in all of its members the...

GST Refund claims Taxpayers who have paid additional GST payments, such as taxes, interest, fines, and fees, may access these items. Refund requests must be made using the GST RFD-01 form by...

GST on Transportation of Goods GST on Transportation of Goods Transportation is an important part of the economy since it disrupts the whole business channel. As a result, variations in gasoline...

Copyright Infringement in India Copyright Infringement in India- The right to reproduce, distribute, display, or perform the protected work, as well as the right to develop derivative works, are all...

GST Appeal Process GST Appeal Process The taxpayer has three months to file an appeal from the day the GST Officer communicated the ruling. Within seven days of electronically filing the appeal, the...

All about Trust Registration All about Trust Registration People establish trusts to give another person control over a portion of their assets or real estate. A trust is created with another...

Residential Status for Income Tax Residential Status for Income Tax The length of time a person has spent living in India during the preceding five years determines their residence status. The amount...

Form 15G Income Tax A declaration known as Form 15G requests that interest payments be exempt from TDS. If the taxpayer’s total income falls below the taxable threshold, they may employ this...

Sound Trademark in India In India, a series of musical notes can be patented as a sound, with or without words. In the US, sound trademarks are widely utilised, and in India, knowledge of them is...

Types Of Customs Duty The term “customs duty” refers to the tax placed on commodities as they transit international boundaries. The Customs Act and Customs Tariff Act (CTA), together with...

GST Interstate v/s Intrastate Supply The terms interstate and intrastate are crucial in determining the (Integrated Goods and Services Tax) IGST, (Central Goods and Services Tax) CGST, or (State...

What is Sale Deed? A sale deed is a legal document that shows the transfer of property from the vendor to the consumer. The property-purchase procedure is completed when the selling deed is...

Agriculture Infrastructure Fund Shri Narendra Modi, India’s Prime Minister, announced a new Rs. 1 lakh crore financial project under the Agriculture Infrastructure Fund (AIF). The Agriculture...

What is NFT? NFT stands for a non-fungible token, which means it is unique and cannot be replicated or exchanged. Non-fungible tokens (NFTs) are blockchain-based cryptographic assets with unique...

Companies in Section 8 When someone hears the name of a firm, the first thing that springs to mind is its name. The importance of a good name rises in the case of a non-profitable organisation (NGO)...

What is PAN All Indian taxpayers are given a PAN (Permanent Account Number), which is a special number. A permanent Account Number (PAN) is a computerized system that keeps track of all tax-related...

Section 80G Deduction Section 80G Deduction One of the best ways to cut taxes while also benefiting the world is to donate to a charity. There will be a section 80G deduction as a result. These must...

How To Start A Clinic How To Start A Clinic – The healthcare sector is one of India’s key industries, with a market size of 6.5 Lakh CRORES and an annual growth rate of 22.9 per cent...

Company And LLP Tax Return Filling A limited liability partnership (LLP) is a legal structure created under the Financial Obligation Partnership Act of 2008. It is legally distinct from its linked...

GST Rate on Alcohol Based Hand Sanitizers GST Rate on Alcohol-Based Hand Sanitizers- The hand sanitizer industry is currently expanding as a result of the COVID-19 outbreak. With the enormous increase...

MSME Registration Procedure in India and Required Documents The government offers specific benefits to small enterprises in the form of subsidies and incentives to encourage entrepreneurship. Banks...

Director Disqualification The Ministry of Corporate Affairs recently suspended almost 2 lakh directors of firms that failed to file their MCA annual filings. As a result of MCA’s recent...

TAN Registrations TAN is an abbreviation for Tax Deduction and Collection Account Number – A Tax Deduction Account Number or a Tax Collection Account Number is issued by the Income Tax...

Identical or Similar Trademark If a trademark is identical or confusingly similar to a brand or trademark that has already been registered, it cannot be registered. A trademark shall not...

GST Rate for Goods Transport Services The GST Council has connected all GST rates to service accounting codes (SAC codes). The Service Tax Department will utilize the SAC Codes to ascertain the taxes...

Trademark Application Forms Trademark Application Forms– A trademark registration application must be presented on the correct trademark application form to prevent an Examiner’s...

Input Tax Credit For Imports The GST system gives a temporary tax credit for IGST and GST offset taxes paid when items are imported into India. After the implementation of GST on July 1, 2017, all...

Rights and Duties of Partners in a Partnership Firm– A partnership agreement establishes communication between participants in a corporation. As a result, each partner taking part in the...

How to Start a Realestate Business? A real estate business is a business entity that buys, sells, manages, and invests in real estate. Real estate is defined as “real estate, land, buildings...

What is Cryptocurrency and How Does it Work? A cryptocurrency is a digital currency, which is an alternative form of payment created using encryption algorithms. The use of encryption technologies...

What is GST Invoicing? GST Invoicing – A GST Invoice is a statement or receipt for goods supplied or services rendered to a client by a merchant or service provider. It details the...

Patent for Business Idea in India Patent for Business Idea in India– To get a competitive advantage, many entrepreneurs seek a patent for a new company concept or strategy they’ve devised...

How Can One Make A Start-Up Successful? How Can One Make A Start-Up Successful? – Everyone wants to be the exception, but building a multimillion-dollar company in a year is simply not feasible...

Promoter Of A Company The Person Behind The Processes A team must work together in order to build an empire; one individual cannot do it. Their initiatives and challenges are ultimately responsible...

Zero-Rated Supply Under GST A GST-registered taxpayer’s export supplies are classified as zero-rated supplies. GST refunds are available for zero-rated supplies. Taxpayers must list all...

Different Types Of Accounting Services Accounting is the practice of keeping track of a company’s financial data. It entails the recording, summarizing, analyzing, and reporting of all...

What is DIN? – A DIN, a unique identification number, is given to a person who is appointed as a director of a company in accordance with Sections 153 and 154 of the Companies Act of 2013...

How To Start a Spice Export Business in India?– India is frequently referred to as the spice capital of the world. The history of the spice trade in India, which goes back thousands of years...

Financial Ratios for Business -Simply said financial ratios are tools that may help you turn your raw data into information that will help you manage your organization more efficiently. Gross sales...

E-Way Bill – The E-Way Bill is an Electronic Waybill for goods transportation that is created using the eWay Bill Portal. Without an e-way bill created on ewaybillgst.gov.in, a...

A legal document known as the Articles of Association (AoA) lays out the goals of a company and the regulations that will govern its operations. The article outlines the proper way to carry out duties...

A Memorandum of Association (MOA) is a legally binding agreement that contains the specifics of a business’s constitution and serves as the foundation for the business’s structure. It is...

How To Make a Pitch Deck? – There may be a thousand reasons that your firm is fantastic, however, after a brief presentation or pitch only a few people can recall them. So, in this post, we...

What should be included in a pitch deck? – If you’re soliciting funds for your company, possessing an appealing pitch deck is a must-have weapon in your funding arsenal. An excellent pitch...

A pitch deck is a brief presentation that gives potential investors or customers an overview of the company’s strategy, products, services, and growing momentum. As a business owner, you are...

The balance sheet, one of the three basic financial statements, is essential for accounting and financial modeling. The balance sheet lists all of the company’s assets along with its funding...

What is a “Proforma Invoice,” and what does it mean? There are a variety of reasons for this document to be delivered to the buyer, most commonly before the transaction has been completed...

Difference Between Bookkeeping and Accounting Services – In the minds of most individuals, the line between bookkeeping and accounting is difficult to discern. While bookkeepers and accountants...

Accounting Services That Small Business Needs – Accounting services provided by a third-party firm may help you save time, avoid costly mistakes, and potentially lower your taxable income...

What Is Accounting And Bookkeeping Services? – Keeping track of finances is a major part of running a company. It’s a necessary component of running a company. Even if you don’t...

Why Outsource Accounting Services? – As a business owner or manager, you may find yourself in charge of everything. Being accountable for your firm’s performance and ensuring that...

Advantages of Outsourcing Accounting Services – Hiring an accountant is a challenge for several small firms, start-ups, and entrepreneurs. Particularly if they have the necessary abilities to...

How Much Do Accounting Services cost? – Accounting & Bookkeeping are indeed critical components of a small business’s sustainability. Not only do they create a solid basis for the...

Accounting professionals are involved in recording and analysing business transactions, bookkeeping, and evaluating the financial capacities of corporations and organisations. Accounting...

Anyone in India can form a partnership firm through a written or oral agreement. Under this agreement, two or more people agree to split the profits from a business run by all or any of the partners...

How To Do Accounting For Small Businesses? In this blog, you will learn how to do accounting for small businesses. Maintaining accurate records of all revenue and expenditures and extracting financial...

After registering a business and obtaining Udyam Registration, one could be able to benefit from a lot of options. The greatest feature of obtaining Udyam Registration is that it is a painless task...

Documents Required For GST Registration For Company: In India, a private limited corporation is administered by the Ministry of Corporate Affairs (MCA). It is simple to register a business with India...

Indian E-commerce is thriving and growing exponentially every year. It is expected to expand six to ten times during the next five years. According to the most recent research, more discretionary...

Project finance refers to the use of a non-recourse or limited recourse financial framework to support long-term infrastructure, industrial projects, and public services. The cash flow created by the...

How To Raise Funds For Startup How To Raise Funds For Startup: There has never been a finer moment in India’s history to launch a company. The startup environment is booming like never before...

Best Sharda Associates 2025-26 How To Raise Funds For Business: Even the most innovative business ideas or techniques can only get a startup company so far. As a result, it’s almost certain your...

The term “e-commerce” refers to businesses and individuals that purchase and resell goods and services online. E-commerce can be done on computers, tablets, cellphones, and other smart...

As per a recent announcement from the Central Board of Indirect Taxes and Customs, some goods providers with an annual turnover of less than Rs./10 lakh are exempt from GST registration. Nonetheless...

Document required for GST registrations for proprietorship GST registrations for proprietorship: Everyone who makes taxable intra-state supplies of goods or services with a yearly aggregate turnover...

Mudra Loan Eligibility Criteria: The Micro Units Development and Refinance Agency (MUDRA) Loan Scheme, commonly known as the Pradhan Mantri Mudra Yojana, is a government of India initiative that...

MUDRA Loan Requirements: MUDRA Loans are made available under the Pradhan Mantri Mudra Yojana (PMMY). The abbreviation for Micro-Units Development and Refinance Agency (MUDRA) stands for Micro-Units...

Mudra Loan Procedure: Any Citizen of India with a business plan for a non-farm income-generating activity such as manufacturing, processing, trading, or the service sector and a credit requirement of...

Mudra loan Eligibility Document: Permitted and eligible financial institutions, such as public and private sector banks, non-banking financial companies (NBFCs), small finance banks (SFBs)...

How to apply for a Mudra loan How to apply for a Mudra loan: Mudra loans are offered to Indian nationals who have their own company ideas in the service industry, commerce, or manufacturing and...

Mudra Loan Details: Mudra Yojana is a financial effort aimed at assisting micro-businesses by giving them adequate finances to enable them to grow. On April 8, 2015, the government launched its MUDRA...

MUDRA Loan Scheme: The Pradhan Mantri MUDRA Yojana (PMMY) is a scheme introduced by the Hon’ble Prime Minister on April 8, 2015, that provides loans of up to ten lakh rupees to non-corporate...

Mudra Loan Eligibility: MUDRA Loans are made available under the Pradhan Mantri Mudra Yojana (PMMY). Micro-Units Development and Refinance Agency (MUDRA) is an abbreviation that stands for Micro-Units...

Advantages of Accounting: The primary goal of maintaining accounting books is to obtain knowledge on the financial situation of a company’s operations. Basic Advantages of Accounting That You...

What is e-RUPI : Honorable PM Narendra Modi inaugurated e-RUPI, a personal & function-based cashless payment system, through videoconference on 2nd August. In his remarks on the occasion, he...

Udyam – With effect from 1st July 2020, the Indian government, Ministry of Small and Medium Enterprises notified composite criteria made up of both investment and turnover as criteria for...

Section 80C – Any adjustment in Section 80C of the Income Tax Act specifically affects taxpayers, meaning that the expenditure is carefully checked for such adjustments. Section 80C is by far...

New ITR portal 2.0: On 9 June 2021, Income Tax Department introduced a redesigned income tax e-filing platform, that includes a number of new features and is meant to provide taxpayers with a faster...

Section 24 – The building or buying a new home is a difficult challenge. To bring this vision into possibility, an average citizen spends all of his life’s savings and even takes out a...

Section 194M requires a person and/or a HUF to deduct tax at source. Individuals and HUFs in this situation should not be expected to have their books audited. If a company’s total turnover or...

Section 194H specifies the rules for Tax Deduction at Source on commissions and brokerage by a resident citizen. Individuals who pay brokerage or commissions are eligible for a tax exemption under...

RBI Tax Savings bonds – The Government of India offers bonds from time to time in order to finance public welfare programs, raise economic activity, and assist people in participating in the...

Leave Encashment Tax – The company provides paid leave to all employees, although not all leaves are available to the employee during the period of work. You should, therefore, encash some...

The rules for a company or entity’s tax audit are outlined in Section 44AB of the Income-tax Act of 1961. The aim of the tax audit is to verify that the taxpayer has obtained accurate and full...

An individual or corporate body has a distinct revenue stream. If their revenue crosses a specific threshold, they must pay the government a specific percentage of taxes. The Income Tax Act has a...

What is Section 143(1): Have you got a notice under section 143(1)? Don’t be concerned! It isn’t always accompanied by demand or note for the payment of income tax. It will represent the...

What is Section 192: TDS on salary revenue is dealt with in Section 192. It requires any contractor to withhold TDS on payroll payments if the worker’s salary reaches the basic exemption cap...

Calculate Income Tax on Salary – As per the IT Act of 1961, any salaried person is required to pay a portion of their salary to the government as tax. This is referred to as the income tax. The...

Section 54F – The meaning of capital assets is found in Section 2(14) of the Income Tax Act, 1961. Capital assets are classified into two groups based on holding period: Short Term Capital...

Form 15G and 15H? – If your overall income is not taxable, what would you do to ensure that your bank may not withhold TDS on interest? When the interest income exceeds Rs.40,000 per year, banks...

What is Cost Accounting? Cost accounting is a form of managerial accounting that tries to measure a company’s overall production cost by calculating variable costs of each production period and...

Limitations of Profit Earnings Ratio – P/E Ratio is the ratio of a business’s present share price to its earnings per share (EPS). For the estimation of this ratio, investors can...

In this post we will learn how to calculate profit earnings ratio. The P/E Ratio denotes the correlation among a business’s share value and its earnings per share (EPS). It is a famous metric...

The P/E Ratio assists investors in determining the fair value of an equity in relation to the business’s profits. In layman’s words, you learn just how much the market is able to pay for a...

In this post we will learn How to calculate Accounts Receivable Turnover Ratio, Step by step. Accounts Receivables Turnover indicates how a company utilizes its assets. It is an accounting metric...

The accounts receivable turnover ratio, also recognized as the debtor’s turnover ratio, is a productivity ratio that calculates how much a business collects income – and thereby how well it uses...

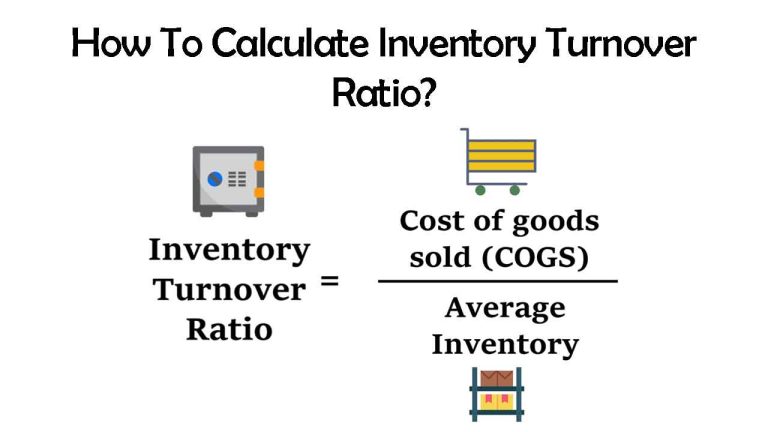

Inventory turnover ratio is an indicator of how many times a company sells its average stock for a given time span. The greater the merchandise turnover, the greater the revenue production. Businesses...

Inventory turnover ratio is a financial ratio that maintains a relationship between sales expense, also known as cost of products sold, and average inventory kept over the time. It’s also known...

The inventory turnover ratio, also recognized as stock turnover ratio, is just an indicator of how well inventory is handled. The inventory turnover ratio calculation is proportional to the COGS...

How to Calculate Fixed Asset Turnover Ratio: The fixed asset turnover ratio is an indicator of a business’s productivity and is calculated as a return on fixed assets like land, factory, and...

Advantages and Limitation of Fixed Asset Turnover Ratio – Fixed Asset Turnover Ratio is a ratio that shows how efficiently a company has used fixed assets to achieve sales. It compares net sales...

The fixed asset turnover ratio is a productivity ratio that compares net sales to fixed assets to calculate a company’s return on investment in land, factory, and equipment. In other words, it...

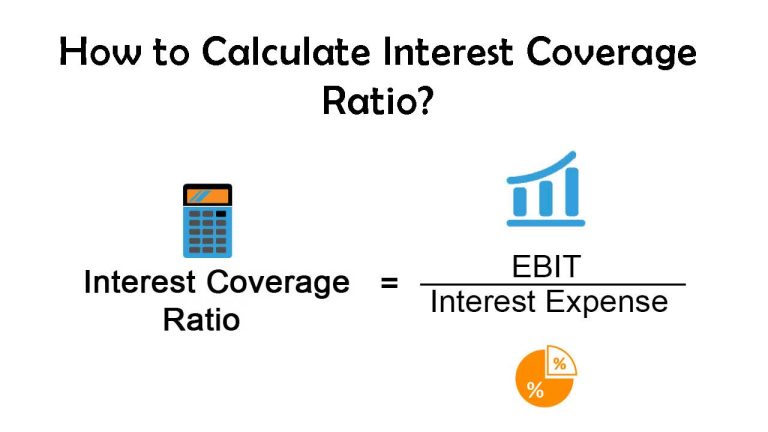

How to Calculate Interest Coverage Ratio – The ICR assesses a business’s potential to charge interest on its accrued obligations. Creditors, lenders, and investors utilize this metric to...

Importance & limitation of Interest Coverage Ratio – Numerous financial metrics, such as the ICR, act as a test on an organization’s solvency. Companies, investors, and financial...

The interest coverage ratio evaluates a business’s capacity to repay its debt. It is one of the leverage measures which can be utilized to determine a business’s financial health. Both...

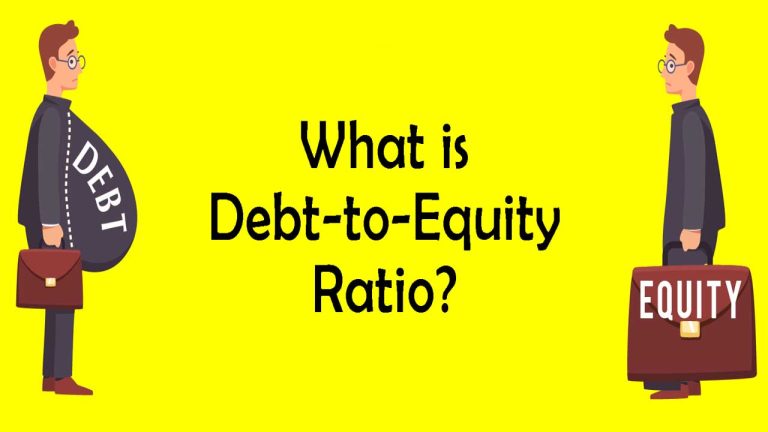

Importance & limitation of Debt to Equity Ratio – The d/e ratio is calculated by dividing the firm’s total liabilities by the shareholders’ equity. This measure is expressed in...

How to Calculate Debt to Equity Ratio? : In this post we will learn how to calculate debt to equity ratio step by step. The debt to equity ratio also called d/e ratio is used to measure a firm’s...

The debt to equity ratio describes how much debt & equity a company utilizes to fund its activities. The debt of a firm has always been its long-term debt, like loans with maturity periods of more...

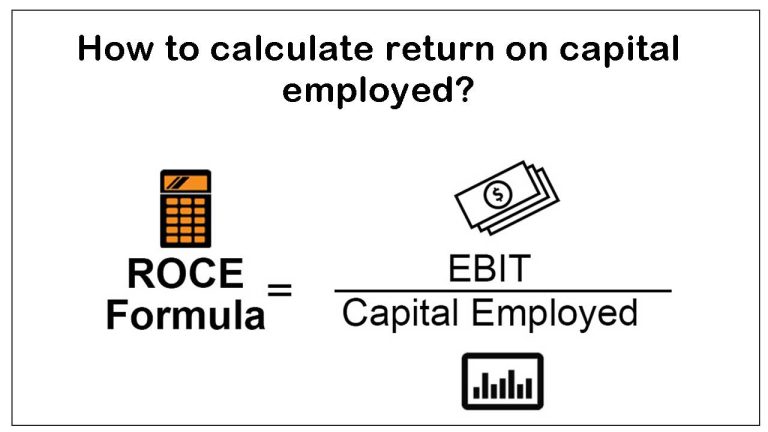

Limitations of Return on Capital Employed – There are several metrics for calculating a firm’s profitability and several investors prefer to return on capital employed (ROCE), a...

In this post we will talk about why Return on Capital Employed is important? ROCE is a useful metric for evaluating the output of firms in capital-intensive industries, like the telecommunications...

In this post we will learn How to calculate Return on Capital Employed, step by step. ROCE, or Return on Capital Employed, is a profitability ratio that calculates how effectively a business uses its...

Return on Capital Employed – All businesses focus on ensuring that they give greater returns to their investors by utilizing their total capital, resulting in higher profits and returns...

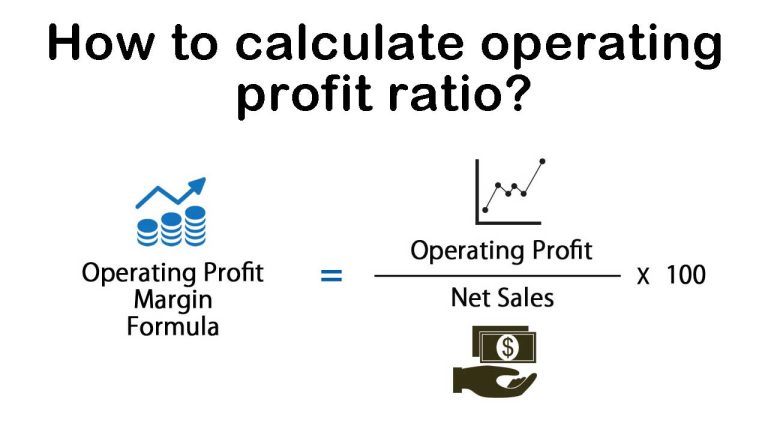

The Operating Profit Ratio expresses the amount of profit generated from a business’s activities before taxes and interest costs are deducted. It’s determined by multiplying operating...

How to calculate operating profit ratio – The operating profit ratio provides a connection among operating profit and net revenue obtained by operations (net sales). Operating profit ratio is a...

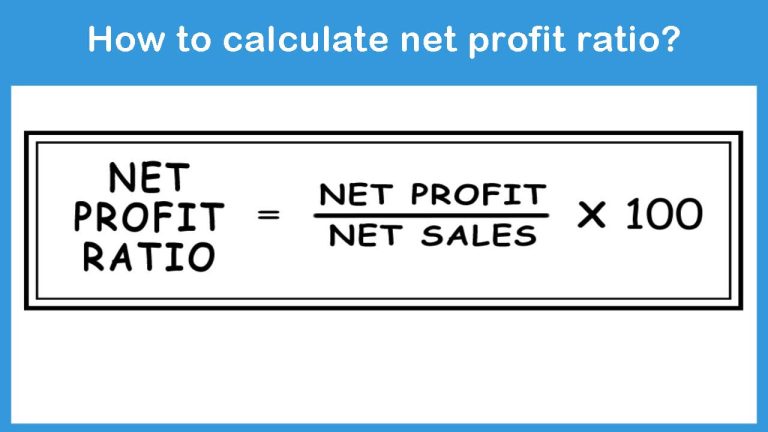

How to calculate net profit ratio : One of the most effective ways to assess a business’s performance is to calculate its net profit. When all of your taxes have been paid, your net profit is...

The net profit ratio is an important instrument for financial research and one of the profitability ratios. The outcome is a concern for any business. A company’s net profit after taxes is...

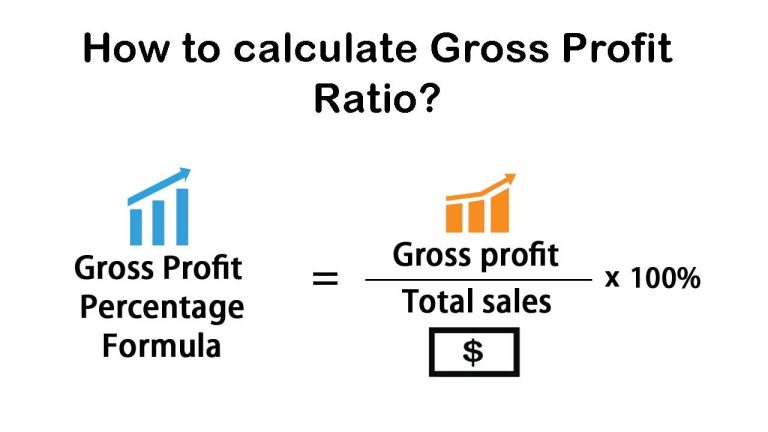

The gross profit ratio is an indicator of a company’s overall profitability. It is represented as a percentage of a business’s operating profit of its sales or revenue. The disparity...

Significance of Gross Profit Ratio – The key benefit of the GP ratio is that it is an effective measure of how quickly a business sells its products and services. This would provide management...

In this post we will learn how to calculate Gross Profit Ratio, step by step. It creates a relationship between gross profit obtained and net revenue derived by operations. It also is recognized as...

Fully understanding a business’s gross profit ratio will help you figure out how effectively it manages its resources. Irrespective of the products or services a business offers, identifying the...

Current ratio vs Quick ratio – Before investing in a stock, investors should use financial analysis to assess a business financial performance. It needs a variety of formulas, ratios, and...

In this post, we will learn about the Advantages and Disadvantages of Quick Ratio. Here is a short story that covers what a Quick ratio is. The quick ratio is used to test business liquidity and...

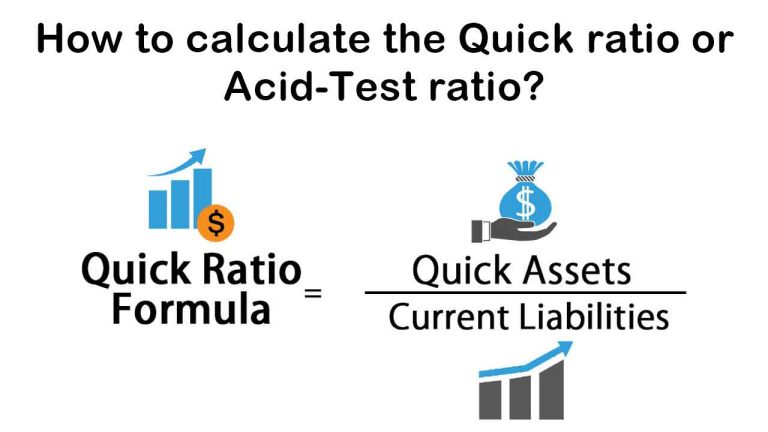

In this post we will learn how to calculate the Quick ratio or Acid-Test ratio with an easy example. It is a liquidity ratio that determines whether a business’s short-term assets are adequate...

Quick Ratio – Cash powers business activities and a shortage of it will drive a business bankrupt. Cash is used to cover urgent expenses like salary and pensions, supplier invoices, inventory...

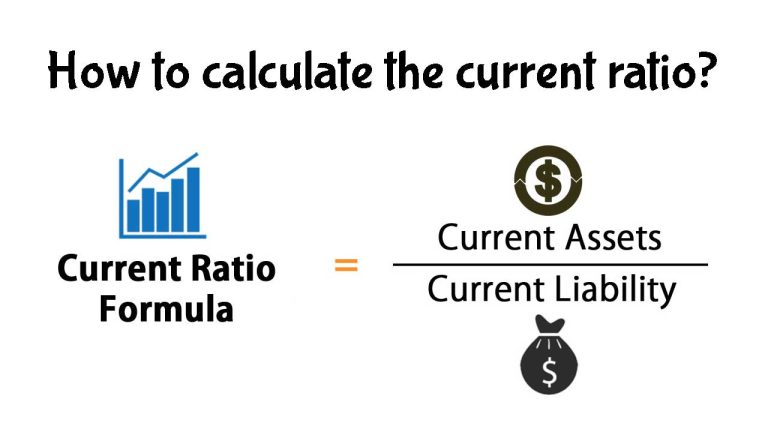

Significance of the current ratio Significance of the current ratio – A company maintains some amount of inventory in order to avoid an out of stock scenario. Likewise, it keeps a small amount...

Advantages and Disadvantages of Current Ratio – The current ratio is a widely used ratio for financial analysis of a business because it provides an overall a business’s liquidity...

In this post you will learn how to calculate the current ratio – step by step. The current ratio is a widely known business metric for evaluating a firm’s short-term liquidity in relation...

The Current Ratio is also known as the Working capital ratio, is used by business to calculate their potential to pay off their short term liabilities (within 1 year) using their current assets. It...

Ratio analysis is the method of evaluating financial ratios which are required to reflect a firm’s current financial output utilizing a few different forms of ratios like liquidity...

Liquidity Ratio Liquidity Ratio – A company needs liquid funds to cover its quick commitments. The capability of a company to pay the money owed to the shareholders when it becomes due is...

Profitability ratios are a group of financial metrics which are applied to determine a company’s potential to produce profits over time in relation to its revenue, operating costs, balance sheet...

Solvency Ratio Solvency Ratio – All the financial resources used to operate a business are not collected directly from the founders. Businesses often incur debt to fund their operations, which...

What is the Turnover Ratio ? A mutual fund which invests in 100 stocks & substitutes 50 stocks in a year, for instance, has a turnover ratio of 50%. Few funds keep their stock positions for much...

Here are few importance of ratio analysis – Aid to Measure General Efficiency: Ratios allow for the summarization and simplification of vast volumes of accounting data. They serve as a measuring...

Advantages & Limitations of Ratio Analysis – Ratio analysis may demonstrate how a business has progressed over time as compared to another company in the same market or field. Although...

When a company’s financial statements have been produced, they must be evaluated. Ratio Analysis becomes one such method for analyzing and assessing a company’s financial condition. It...

GSTR 4 is a form that approved taxpayers who have signed up for the composition scheme must submit a return once every three months. They are also called composition vendors. The GSTR-4 provides the...

The GSTR 7 is a paper or declaration submitted by individuals who subtract tax from payments made to suppliers for inward supplies received. This return would include the specifics of all sales on...

The GSTR 10 is a document or statement which a GST registered individual must file if they want to terminate their GST registration or close their company, be it willingly or due to a government...

GSTR-2 is a purchase return that must be submitted by all GST licenced individuals. In the GSTR 2, taxpayers must insert information about their inward supplies. The GSTR-2 is a monthly tax return...

GSTR 2A contains information related to the purchase that the GST portal produces automatically for each company. Whenever an individual submits his GSTR-1, the data is recorded in GSTR 2A. It obtains...

In comparison to GSTR 1 and GSTR 2 forms, GSTR-3B is essentially a monthly self-declaration submitted by a registered individual. It is a compiled collection of inward & outward supplies initiated...

GSTR 1 is a quarterly or monthly return that provides information about a business or individual’s outward supplies. It contains all of the information about debit notes, credit notes, revised...

GSTR 9C – Any enrolled individual whose turnover throughout an FY exceeds ₹5 crores must have his financial statements audited as stated u/s 35(5) of the CGST Act, and must supply a replica of...

GSTR 9 GSTR 9 is a yearly return that registered taxpayers must file underneath the GST). As it is an annual return, it is only filed once at the completion of the financial year and provides reports...

Section 9 of the Income Tax Act Section 9 of the Income Tax Act – In India, the Indian Income Tax Act provides us with a levy of income tax on the income which is earned from the foreign...

The pay of the employee or employer is based on Section 15 of the Income Tax Act. It will be subject to income tax under the following sections for “Salaries”: The salary is required on...

Section 17(1) – Salary is the compensation earned by or accumulating to an individual on a regular basis for services performed under an express or implied contract. In terms of taxability, the...

Section 80RRB was implemented to assure that anyone who has performed an incredible job receives their reward. To motivate people to continue creating high-quality work, this section requires them to...

A tax break is available to assessors who offer infrastructure growth services under Section 80IA. Under such a section, qualified assessees may, for a predetermined period of time, get a tax...

Section 80JJAA – This is a new section referring to the deductibility of extra employee costs. It is effective beginning with the AY 2017-18. Throughout this post, we would go over the terms...

Section 80ccf – Investors who have invested in bonds especially for tax saving purpose and infrastructure profit from Section 80CCF of the Income Tax Act, which would be a huge victory for both...

Section 80TTB – For elderly people, old age is sometimes linked to health problems, both physical and mental, that carries a huge toll on their finances. As a result, it is important to give...

Section 80GGC – Individual taxpayers can deduct donations given to an electoral trust or political party from their gross revenue under section 80GGC of the Income Tax Act. The entire donation...

Section 80GGB provides tax exemption for gifts to political groups in order to stimulate more donations. This part of the Income Tax Act of 1961 primarily addresses gifts and profits generated by...

Amendment in the Income Tax – Income tax is a direct tax levied by the government on the earnings of its residents. The Income Tax Act of 1961 requires the central government to receive this...

Amendment in tax laws Amendment in tax laws – The Income Tax Act of 1961 is a law that governs the levy, administration, collection, and recovery of income tax in India. The act entered into...

The money offered to charity is deductible under section 80G of the Income Tax Act. Section 80G is in the law since FY 1967-68 and appears to be here for a long time. Several exemptions were...

The Income Tax Act of 1961 (IT Act, 1961) grants different tax incentives to mitigate the tax obligation when expenses are paid for self/family health bills or where the tax assessee or his/her...

First and foremost, Section 80DDB allows a deduction for direct medical expenses accrued in the care of specified illnesses for the taxpayer, partner, offspring, parents, and siblings. The array of...

Section 80U – Certain provisions of India’s income tax laws offer tax advantages to people if they and any of their close relatives suffering from several illnesses. Section 80U provides...

Individuals and HUFs may seek a tax benefit under Section 80DD of the Income Tax Act for medical care of a person with a disability or differently-abled. The sum deducted would also cover premiums...

GST rate on cement – India is the 2nd largest cement manufacturer in the world. The Government of India is very interested in the development of infrastructure, inexpensive housing and highways...

Section 80D – Medical emergency situations often take place by surprise. It’s always safer to be protected than blindly taking a risk, and it’s no exception when it applies to...

Section 80E – An education loan not only lets you fund your expensive education, but it could also save you a hefty tax. If you have already obtained an education loan and have started paying...

Section 80GG Typically HRA is a component of your salary and you could demand a deduction for HRA. If you really do not earn HRA from the employer and transfer funds for rent for just about any...

Section 80CCD – Paying the income tax in a proper and timely way is vital to national economic development. You have to file your taxes before the deadline as an accountable Indian citizen. The...

Partnership at will – A partnership deed at will is a place where there is no time duration of the business. Till, there is a hint to prove otherwise, a partnership of this sort can be begun and...

Dissolution of partnership and the dissolution of the partnership firms are two different concepts. In this, we will study the dissolution of the partnership. Dissolution of Partnership means a change...

A partnership deed is a type of partnership agreement among the members of the firm which defines the terms and conditions of the partnership between the two partners in a firm or company. The main...

What is a Sole Proprietorship? – A sole proprietorship is a type of straightforward business that can be operated by one individual only; it is not considered to be a legal entity. It...

How to register a sole proprietorship in India – A sole proprietorship is a form of simple business which can be done by a single person also, it is not included as a legal entity. It classifies...

Partnership Firm – Individuals that have stepped into a partnership with each other to conduct a business is generally referred to as “Partners;” jointly referred to as a...

What Is One Person Company – It is a new concept that has been introduced in the Companies Act 2013, about the One Person Company (OPC). In a Private Company, there is a minimum of 2 number...

How To File TDS Return – Tax Deducted at Source or TDS is a source of collecting the tax by the Government of India at the time when the transaction takes place. Now, the tax should be deducted...

The Income Tax Act allows for separate income tax exemptions that can be reported at the moment of filing ITR. The total taxable income will be taxed in accordance with the person’s income tax...

Section 80CCC allows for deductions of ₹. 1.5 lakhs per year for donations rendered by a person to defined pension funds. Section 80 CCC of the exemption limit also covers income spent on the...

When is E-way bill not required – In India, the GST legislation was enforced to redress a lot of the troubles which the former law had. Among the biggest issues being the absence of...

Vivad se Vishwas Scheme – The finance minister of India Smt. Nirmala Sitharaman introduces a new scheme for setting the pending for the taxpayers. The scheme “THE DIRECT TAX VIVAD SE VISHWAS ACT...

Section 194C specifies that any individual liable for paying any amount to a resident contractor for the execution of any work (along with the supply of labour force) pursuant to a contract between...

Short term funds are debt funds that invest in the debt and money market securities such that the duration of the fund portfolio is between 1 to 3 years. How do Short Term Funds Work? To understand...

The HUF is a family made up of all individuals linearly inherited from the same ancestor, as well as the wives and daughters of the male ancestors. It comprises of the Karta, who is normally the...

E Way Bills is an electronic way to bill for the movement of goods and services for goods to be generated by the e-way bill portal. In GST the registered person cannot transport the goods from...

How to Generate E way Bills –The e-way bill (EWB) platform offers a streamlined interface to produce eWay bills (singular and combined options), adjust the vehicle information onto an already...

Mutual Funds in India started in the year 1963 with the collaboration of United Trust of India to solve the problems of the Government of India and the Reserve Bank of India. A Mutual Fund is a type...

How to file nil GSTR-3B Return – If an individual has not produced an outward supply nor obtained an inward supply leading to no tax liability for a specific month, no GSTR-3B should also be...

How to file Nil GSTR-1 return – GST returns must be submitted each month by everyone who has a GST registration, regardless of the sales or viability of the company The taxpayer then should log...

Types of mutual funds: considering investments in mutual funds? It is therefore of the greatest priority to consider the different forms of mutual funds and the advantages they provide. The types of...

How to file GST return – GST is an indirect tax in India as of 1 July 2017. GST return is the reporting of taxes by means of GSTR forms in compliance with the rules and qualifying requirements...

How to download GST certificate – The GST Registration Certificate is legitimate evidence of registration under the GST. Any company in India whose revenue crosses the GST registration level...

E-invoicing under GST applicability Transport of products between one location to others is enabled by submitting ‘E-Way Bills’ on the GST portal. Likewise, at its 35th meeting, the GST...

Calculate capital gain on shares – In order to determine capital gains on the shares. The purchasing cost of the asset as well as the costs paid or brokerages relevant to the selling of the...

Calculate Capital gain – Calculating capital gains could be a complicated and intimidating process based on the type and amount of transactions performed by the assessee within the FY. It is...

Capital Gain Tax – A capital gain may be characterized as any benefit earned from the selling of a capital asset. The benefit earned comes within the division of profits. It is also necessary to...

How to save tax on capital gain – Profits resulting from the selling of any capital asset are known as capital gains and are differentiated for taxation purposes in the short or long term. It...

How to file ITR-5 – ITR Form-5 (ITR 5) must be submitted by companies such as Businesses, LLPs (Limited Liability Partnerships), AOPs (Personal Association), Artificial Judicial Individual and...

How To File ITR-6 – An ITR is generally a document submitted in compliance with the rules of the itr Income Tax Act, which accounts for one’s income, tax profits and losses, other...

Section 54 – First, let us grasp which part of the revenue is taxable on the sale of the property. Is that the full value earned from the selling of the property? The response to that is NO...

Section 112A was implemented by the Finance Act 2018 to tax long-term capital gains mostly on selling of listed shares, equity-based mutual funds units and units of business trust. Schedule 112A...

Section 89(1) – Taxes are determined from the total income gained or obtained for the year. If your net compensation contains any past fees charged in the financial year, you might be nervous...

It is mandatory to complete Form 10E if you wish to seek tax relief under Section 89(1) of the Income Tax Act 1961. As per Section 89(1) of the Act, you are entitled to seek tax relief for late...

Section 80EE offers income tax savings for the interest component of a residential housing loan made available by any financial institution. One can assert a deduction of ₹50,000 for each FY as...

A presumptive taxation system was adopted in compliance with Section 44ADA of the FY 2016-17. Section 44ADA offers a clear form of taxing small professionals. Section 44ADA offers a method of...

This post deals with the argument of interest deduction under Section 8oTTA. But before that, let’s know what is Section 80TTA? This section offers a deduction of ₹10,000 on interest income...

Section 194A – In order to collect tax easily and effectively, the Income-Tax Legislation has introduced a tax-deductible scheme at the point of income generation. This system is referred to as...

Sources of Income Streams – Without an income stream, the business will collapse. A very basic truth most small companies have a single revenue source, like an electrician or plumber. Getting...

Form 26AS – Prior to actually submitting your ITR, it is advised that you still see your 26AS to verify the amount of tax you have deposited in your account with the income tax department. Among...

Section 234A – There are several penalties mostly in the type of penalties in the Income Tax Act for each error. If people do not pay taxes before the due date or do not meet with tax laws and...

Rent Free Accommodation implies the house made available to you from the employer for residential uses. A few employees also get residence facility from their employer free of cost, although in some...

Budget Highlight 2021 – The total capital expenditure for the FY 2021-22 is Rs.5.54 lakh crore. In view of the need-of-hour change in the healthcare industry, FM suggested a different centrally...

Section 80GGA of the Income Tax Act specifies that deductions may be made for contributions to rural development and scientific research. Any corporation, entity, business or any other party may...

File ITR without form 16 – Being a salaried person, the first and most critical document to submit an ITR is surely Form 16! But what if you haven’t got or lost the very same thing? Would...

Income Tax for Self-Employed – Self-employed is those individuals who sell their services to various employers without the need for a long term deal with either of them. Income Tax Act, 1961...

PMEGP Scheme – PMEGP is the acronym for Prime Minister’s Employment Generation Program is a Government of India-backed credit-linked subsidy scheme Under this scheme, applicants will...

Penalties Under the Income Tax Act – The timely and regular paying of taxes and the filing of returns indicates that the government has public welfare funds at all times. In order to ensure that...

Revised ITR – At the date of submitting the income tax return (ITR), we take the appropriate precautions to never make any errors. Some times, we can make an error when filing our ITR at the...

The Senior Citizen Savings Scheme is a post office savings plan for elderly people in India. It helps you to invest a lump sum with the maximum up to Rs.15 lakhs with the lock-in term of 5 years...

It’s very straightforward to read and in this guide, we will explain how to fill Form 16. It is separated into two sections, Part A and Part B. Form 16 Part A: This section of income tax form 16...

Form 16 is among the most important tax forms for employees and employers. What is Form 16? It is a permit given to workers by their company as they withhold tax from the employee’s pay. In...

Funds for startups – The government is now to offer a total of 1,000 crores to new entrepreneurs, according to Prime Minister Narendra Modi. “We are initiating a ₹1,000 crore startup India...

Union Budget 2021 – One of the most highly anticipated annual policy updates by the government during the last quarter of the FY – the Union budget – is just around the corner. Only a few weeks...

Section 80CCG – Investing in the share market is a vital method to raise capital. The Government has adopted various schemes that promote people to make investments and permit specific methods...

Section 87a – The main obligation of any government is to protect the civilians of its country, and the Government of India has been working actively towards that goal. In order to assist the...

Calculate TDS on salary – The notion of TDS has been formed with the intention of collecting tax from the very source of income. According to TDS, an individual (deductor) who is responsible to...

Income Tax Exemptions for Political Parties – Political groups in India are regulated by the Representation of the People’s Act, 1951 (RPA). Any alliance of Indian people or body of...

The Indian Income Tax Act contains regulations for both the collection of taxes at source. In these provisions, specific individuals are needed to gather a specific portion of the tax on extraordinary...

FSSAI Penalty – FSSAI looks after food companies in India and checks whether or not they comply with the government’s regulations. Their purpose is to confirm that the food is not...

FSSAI Registration – FSSAI Registration is a simple license but is needed for all FBOs participating in the small-scale food sector. This category refers to the following companies: Any FBO with...

FSSAI is an acronym for the Food Safety and Standards Authority of India, an organization that oversees and manages the food business in India. It is an independent institution founded under the...

Any private company should have at least two directors, and every public company should have at least three directors at any one time. Let us take a look at three potential scenarios during the...

CERSAI is an acronym for Central Registry of Securitisation Asset Reconstruction and Security Interest of India. The Central Registry of Securitisation Asset Reconstruction and Security Interest of...

When starting a new project, One of the most commonly asked questions is what legal entity should be set up? Based on the type and scale of the company, some of the alternatives options to the legal...

Gumasta License is a registration necessary for performing any type of business in the state of Maharashtra. It is regulated by the Municipal Corporation of Mumbai underneath the Maharashtra Shop and...

A Complete guide ITR 7 shall be filed where individuals, along with businesses, fall within the limits of section 139(4A) or section 139(4B) or section 139(4C) section 139 4 4A or section 139 4C or...

ITR 6 – Firms apart from those seeking an exemption under section 11 shall apply their tax return on profits in the form of ITR-6. What are the companies who demand exclusions under section 11?...

A complete guide ITR 5 is for companies, Limited liability partnerships, Associations of Persons and bodies of Individuals, Artificial Juridical Persons, Estates of the deceased, Estates of the...

A Complete guide The ITR-4 form is for all those taxpayers that have applied for a presumptive income scheme in compliance with Section 44AD, Section 44ADA, and Section 44AE of the Income Tax Act...

A Complete guide ITR 3 refers to individuals and HUFs that have revenue from business or professional sales and profits. Individuals with earnings from the preceding sources are entitled to file ITR...

A Complete guide The IT Department of Income Tax classified taxpayers on the grounds of income, the origin of income, and several other considerations to ensure simple enforcement. Taxpayers with...

ITR – 1 – The income tax department has grouped taxpayers into several categories depending on income and its source, to make tax enforcement simpler. So, you need your taxes to be filed...

CEFPPC Scheme The key purpose of this policy is the formation of processing and preservation capacity and the modernisation/expansion of established food processing units with a commitment towards...

Corporate restructuring is a measure taken by a business organization to substantially change its capital structure or activities. Usually, it occurs while a corporate company is facing major...

What is TDS: TDS also know as Tax deducted at source is income tax withheld from the money collected at the period of paying specified expenses like rent, commission, professional fees, wages...

A taxable person under GST is an individual who carries on some business anywhere in India and is registered or required to register under the GST Act. Any individual engaged in business activity...

Llp vs Pvt – The processes for Private Limited Company and LLP registration are straightforward and somewhat identical to one another. In the establishment of these businesses, we have mentioned...

In short, LLP is a company in which at least two partners are required and can have a maximum number of members as they need. The responsibility of an LLP’s participants is restricted. In LLP...

A Private Limited Company is a business which is held by a small group of people. The liabilities of the shareholders of the Private Limited Partnership shall be limited to the corresponding amount of...

Accounting Services that a small business: Finally, you’ve got all the items of the entrepreneurial puzzle in position perfect idea, a fantastic spot, a good strategy, and the financial muscle...

GAAP – Accounting is also referred to as the process of recording, classifying, and summarizing financial records. As in every type of craft, accounting often requires the use of one’s...

Capital budgeting consists of two terms ‘capital’ and ‘budgeting.’ In this sense, capital spending is the expenditure of money for major expenses such as the acquisition of...

The Accounting Rate of Return (ARR), also generally referred to as the average rate of return, calculates any capital investment’s anticipated profitability. ARR uses basic calculations to show...

Income Tax On Agricultural Income – In India, agriculture is indeed the primary occupation. For the people living in rural area in India, it is the only source of revenue. For its essential...

CMA Report – Underneath the Credit Authorization Scheme (CAS), proper permission of the RBI for credit beyond the defined caps is necessary. These requirements and the credit restrictions have...

Types of ITR – The Income Tax Return (ITR) is a process wherein taxpayers provide the IT department with details regarding their income and tax payments. A taxpayer could file an ITR on or prior...

The GST legislation specifically specifies the definitions of the crimes and the punishments imposed under each case. This is vital knowledge for all company owners, CAs, and tax practitioners as an...

Writers write a novel and send it to publishers. Publishers publish them and benefit from selling it. They give the negotiated amount of income or sales made to the writers as a payment or payment for...

Income Tax Exemption For NRI – Similarly to residents, NRIs are also eligible to assert different deductions and exemptions against their overall profits. Below are the deductions for NRI:...

Taxable income for NRI – Your income is taxable if you earn your wage in India or if anyone is doing it on your side. Besides that, if an individual is NRI and you earn your income directly from...

Income tax for NRI – We all understand as taxes received from taxpayers are the pillar of our economy. NRI Taxation in the Indian Income Tax Act, 1961 refers to non-domestic earnings. The income...

What is short and long term capital gain tax – Investment in residential properties is among the highly sought-after assets. The main motive is to own a home, whilst others are investing in...

Capital Gains – Simply put, any benefit or income resulting in the selling of a ‘capital asset’ is called a capital gain. This benefit or gain falls into the umbrella of...

Tax on Inheritance – It is obvious that a person’s property and assets (such as ancestor’s ones) will be carried on by their children, grandchildren, or wards – after...

The profitability ratio is utilized to measure the effectiveness of the business to produce profits in relation to its costs and other costs related to the production of profits for a given time...

What is GST e-invoicing? – The Government of India has formally launched e-invoicing and this revolutionary framework aims to revolutionize the manner we interact with the nation’s biggest...

Benefits Of GST e-invoicing – E-invoicing under the Goods and Services Tax system was launched on a voluntary basis in January 2020 and is scheduled to be incorporated in April 2020. That being...

Income Tax Refund – Return on income tax emerges when you pay taxes larger than your real taxable income. The tax that was paid might be progress income tax refund , self-assessment tax, and...

Gst Rate On Smartphones Hiked – In March 2020, the Center has revised the GST rates on smartphones and increased it from 12% to 18%. This news was not appreciated by a lot of peoples and was...

GST Refund On Export – In general export means selling products and services in the global market. Pursuant to the Act, products, and services that are exported are deemed to be...

Tax Benefits On School Fees – This period of year, parents are busy preparing for admission to a school of their choosing, and students are busy preparing their bags and concentrating on...

Tax Benefit On Life Insurance – Life insurance did come as a obligation ever since we start work and support for our family. Most of us purchase a specific life insurance based on...

Tax Benefits On Buying Home – Purchasing a property with a home loan does have substantial tax advantages in the type of deduction toward paid home loan interest and home loan principal...

If you really have academic and business profits and your taxable income contains such business and professional income, the reports and transaction data (books of account) must be kept and preserved...

Implementation Period of Agriculture Infrastructure Scheme The scheme will be functional between 2020-21 and 2029-30. Disbursement in 4 years starting with a penalty of Rs. 10,000 crore in the first...

Mobilizing a medium-long-term debt financing facility to invest in feasible post-harvest management projects Infrastructure and community farm assets via incentives and financial efforts to improve...

In this post, we discuss what agriculture infrastructure fund is, its need & participant involved. Agriculture Infrastructure fund role is critical for the growth of Agriculture Infrastructure...

The time has come, now it’s your duty as a responsible citizen of India to file the return, let have a look at how the returns can be submitted properly while preventing certain some common...

Section 80C of the IT act, investments up to Rs 1.5 lakh may be claimed for deduction. The most favored investment option in India has been a fixed deposit (FD). Investors of all age ranges appreciate...

Very often the taxpayers get to confront harassment from the tax officials so the government has initiated a faceless tax assessment for the betterment of these taxpayers. Initially, if there had been...

The electronic evaluation is also known as e-assessment is the use of technology in different forms of tax assessment. There are certain benefits and drawbacks of e-assessment under income tax...

The prime minister on his video call announced the new ‘Transparent Taxation. The release of Faceless Assessment, Faceless Appeal, and Charter for Taxpayers. While Faceless Assessment and...

Wealth tax is a direct tax that adapted after the Wealth Tax Act of 1957, which was adopted in 1957 to impose a tax on an assessee’s net wealth. It’s not a tax on his income, but on a...

Startup India is a project of the Indian Government. The initiative was announced in New Delhi by our Prime Minister, Narendra Modi, during his Red Fort address on 15 August 2015. The arrival of the...

Tax Collected at Source or TCS is a direct tax imposed on purchasers of certain products by the retailer. TCS is an income tax paid according to the provisions of Article 206C of the Income Tax Act...

“The toughest thing to fully grasp is income tax,” said Albert Einstein. Why can’t even the intelligent brains understand taxes? Moreover, surprisingly, all our lives are about...

Interestingly, along with the advantages, this scheme also has a few disadvantages. Disadvantages of the Composition Scheme Restricted Business Territory – In order for a taxpayer to be...

Composition Scheme in GST is now an option tax levy technique engineered for small taxpayers whose turnover is up to 1.5 Crores. Acknowledging their importance, the government has made specific...

Developing countries like India with a large variety of enterprises, large and small, in its economy. While mega-industries and MNCs are helping the country stand out in the world economy, mid...

The complexity arising from COVID-19-related effects has transformed how companies operate — and this implies that it has to change the future of audit work. The sudden transition in March 2020 made...

Due to a lack of internal audit experience, new auditors can harbor misunderstandings that may cause uncertainty and tension during an audit. So, what should today ‘s audit leaders do to portray...

PMEGP is a policy initiated by the government of India in 2008. poKhadi and Village Industries Commission (KVIC) is the nodal agency for the policy. The policy will be introduced at the state level by...

business loan is approved for starting a new company, expanding the current acquisition of assets, etc. Many entrepreneurs don’t understand how to apply for a bank loan, and what the...

Business loans are a form of financial assistance that can be used to meet the different demands of a changing or rising enterprise. The lender is confident of granting a business loan to a borrower...

Prime Minister Narendra Modi has introduced Atmanirbhar Bharat Abhiyan(ABA) in his fifth address to the country. The goal of this ‘Self-Reliant India Mission’ is to introduce a truly...

India is now the world’s fastest-growing economy and MSME plays an important role in encouraging investment. India govt: and state govt: offer various kinds of incentive packages here just to...

You might have come across something called CIBIL credit score while you are seeking a loan or testing the eligibility criteria of different lenders. It is vital that you review your credit score...

Micro Units Development & Refinance Agency (MUDRA) Limited is a body set up by the government of India for micro unit growth and refinancing activities. The Hon’ble Finance Minister declared...

Project Reports are important entrepreneurial tools. They play an important role in a business’s phases of startup, ongoing, growth, expansion, and even survival. Over time, companies are able...

The project reports are documents and statements containing full details on the activity of the manufacturing industry of the company and its marketing prior to the creation of the industry In short...